One of the thrills of early retirement can be the first time you write “retired” on a form that asks for your employer. But if you’re applying for a home mortgage, things get tricky. After all, one of the requirements for getting approved for a loan is providing employment and income information. Fortunately, there are plenty of home loans for seniors available.

We’ve worked with thousands of active seniors purchasing their 55+ community homes. So we’ve gathered everything you need to know about getting a home loan as a senior, from loan types to refinance programs and tips to help you get approved.

Read on to find the right mortgage program to make your 55+ community home dreams come true! Review our comparison charts for a quick rundown:

| Loan Guarantor | Credit Score Requirement | Down Payment Requirement | Income Verification | Interest Rates | Eligibility | |

| Conventional Loan | Private lender | High (typically 620+) | High (typically 20% for the best rates) | W-2s and tax returns | Generally competitive | Open to most buyers with strong credit and income |

| Asset Depletion Loan | Private lender | Moderate | Moderate (around 10%) | Assets like stocks, bonds, etc. | May be higher | Substantial assets |

| Bank Statement Loan | Private lender | Moderate | Moderate | Bank statements demonstrating income | May be higher | Self-employed or non-traditional income sources |

| Fannie Mae/Freddie Mac | Government-backed | Moderate | Lower (3-10%) | Various income sources, including Social Security and pensions | Competitive | Easier qualification with a lower down payment |

| VA Loan | VA | Minimum requirements (varies by service) | No down payment for eligible veterans | Military service verification | Typically lower than conventional | Active military, veterans, and their spouses |

| USDA Loan | USDA | Minimum requirements (varies by location) | No down payment for eligible properties | Income limits | Typically lower than conventional | Rural properties that meet requirements |

| FHA Loan | FHA | Lower | Lower (3.5%) | W-2s and tax returns | Lower than conventional | Easier qualification and lower down payment requirement |

If you’re looking to refinance rather than get a new mortgage, check out the chart below for the highlights of each refinance option:

| Feature | Rate-and-Term Refinance | Cash-Out Refinance | Cash-In Refinance |

| Focus | Change interest rate or loan term | Access cash from home equity | Reduce loan amount with cash |

| Cash Impact | No cash provided | Receive cash at closing | Pay cash upfront |

| Loan Amount | No change | Increased loan amount | Reduced loan amount |

| Impact on Monthly Payment | Potentially lower | Potentially higher | Potentially lower |

| Impact on Loan Term | Can be shortened | Can be extended | Can be shortened (optional) |

| Goal | Lower monthly payment or a shorter term loan | Access cash for various needs | Lower monthly payment or a shorter term loan |

| Costs | Closing costs | Closing costs | Recasting fee (usually lower than closing costs) |

| Existing Mortgage | Remains unaffected | Replaced with a new loan | Remains unaffected |

Can Seniors Get Home Loans?

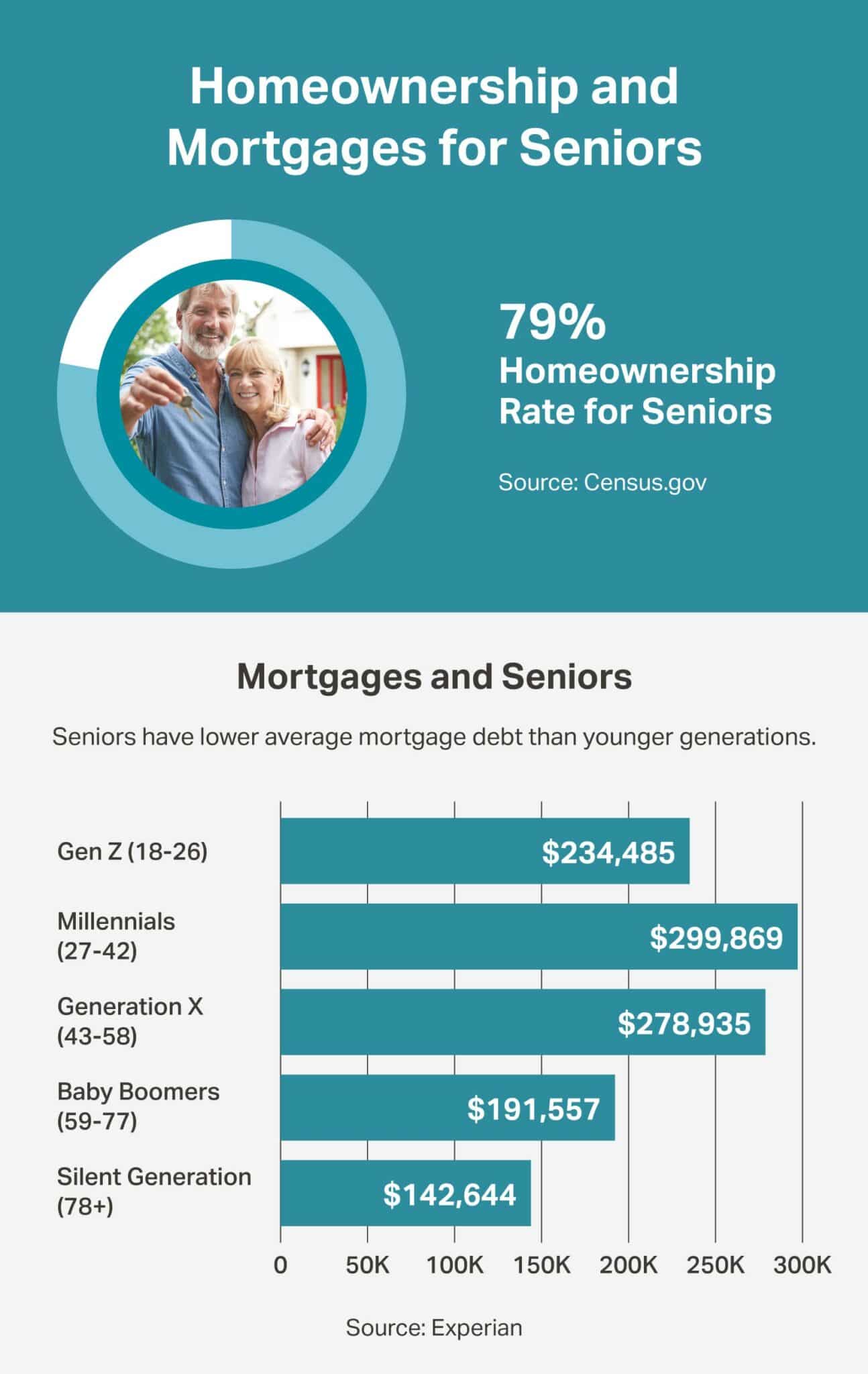

Yes, seniors can get home loans. In 2023, 35% of homebuyers were over 59, and most financed their home purchase. The Equal Credit Opportunity Act guarantees everyone the same opportunity to get a loan. This means your age alone can’t be a factor in determining whether or not you qualify.

As a retired senior, you’ll still need to prove you have income to pay back the mortgage loan to qualify. This means that your income won’t come from an employer. Instead, it will come from various sources, such as pensions and Social Security.

How To Qualify for a Mortgage in Retirement

Moving in retirement is often less stressful as you have more time to prepare. In general, follow the steps below:

1. Check your credit score and make necessary improvements.

Lenders use credit scores to predict the risk in lending to you. The higher your score, the more likely they will extend you a mortgage and the lower your interest rate. Check your credit score as soon as you want to move and start working to improve it.

2. Identify your retirement income sources.

Lenders also want to know how you will cover your mortgage payments. Retirement income sources often include Social Security, pensions, investment income, and withdrawals from your retirement accounts. Gather all this information before applying for your mortgage so it’s easy to find.

3. Check your debt-to-income ratio.

Another factor in lending decisions is your debt-to-income ratio (DTI). To determine your DTI, total all your monthly debts and divide them by your monthly income. The lower your DTI, the more likely they will lend to you. If your DTI is above 50%, you’ll probably need to pay off some debt before you apply for a mortgage.

4. Consider the property type you want to purchase and the loans available.

Determine the property type you’re looking for, whether it’s a smaller house on your favorite beach or an active adult community near your kids. Once you know the property type, explore your loan options. Fannie Mae and Freddie Mac have programs that may help you qualify for a loan if you buy a property that meets their requirements.

5. Explore your down payment options.

Whether it’s your first property or your tenth, you must put down a down payment. Some recently retired people use the proceeds from the sale of their family home as a down payment. Others may take out a home equity line of credit on their family home to purchase a second home. Another common option for seniors is taking out a lump sum from their retirement accounts or investment portfolios, although fees may be associated with those withdrawals.

6. Apply for the mortgage.

Once you have all the information, apply for your loan. You can do this online or contact a lender who specializes in helping retirees like you qualify for mortgages.

7 Types of Home Loans for Seniors

If you’re wondering if there are special home loans for seniors, the answer is yes. However, the best mortgage for seniors depends on your circumstances. We recommend discussing which option is best for you with a financial expert. Check out the seven most common home loans for seniors below, plus some pros and cons of each.

1. Conventional Loans

Great for: Financially secure retirees

A conventional loan is a mortgage loan issued by a private lender, such as a bank or credit union. It’s the most common type of home loan, but the government does not guarantee it.

| Pros of Conventional Loans for Seniors | Cons of Conventional Loans for Seniors |

| Widely available | Requires a down payment (typically 20%) |

| Competitive interest rates (if you have good enough credit) | Has stricter credit score requirements than other options |

| Variety of terms (15-30 years) |

2. Asset Depletion Loans

Great for: Retirees who have lower incomes but substantial assets

An asset depletion loan is a type of niche loan, meaning it is designed to help a specific group of people enter into homeownership faster, thanks to different terms than conventional loans. Asset depletion loans consider all your assets—stocks, bonds, investment accounts, etc.—alongside your income to help you qualify for a mortgage.

| Pros of Asset Depletion Loans for Seniors | Cons of Asset Depletion Loans for Seniors |

| Considers assets like stocks and bonds for qualifying | May deplete your retirement savings faster than you like, leaving you strapped for cash down the road |

| Often has higher interest rates | |

| Has a complex qualification process |

3. Bank Statement Loans

Great for: Self-employed retirees

Bank statement loans qualify a buyer based on bank statements that demonstrate income instead of tax returns. For example, if your income is not reflected on traditional tax forms because you are self-employed, it might be easier to qualify for this type of loan than a conventional loan.

| Pros of Bank Statement Loans for Seniors | Cons of Bank Statement Loans for Seniors |

| Qualification based on bank statements that show income | Not widely offered |

| Tax returns aren’t as important | May require a larger down payment |

| Often has higher interest rates |

4. Fannie Mae and Freddie Mac Senior Homebuying Program

Great for: Retirees who have lower credit or lower savings

Fannie Mae senior housing loans and Freddie Mac senior home loans are mortgage assistance programs offered by private lenders, but they are insured by the government. These government mortgage programs for seniors are designed specifically for the lending needs of retirees. This makes it easier for them to qualify for a loan.

| Pros of Fannie Mae/Freddie Mac Loans for Seniors | Cons of Fannie Mae/Freddie Mac Loans for Seniors |

| Easier credit score requirements | May have a loan amount cap |

| Lower down payment options of 3%-10% | Limited to specific property types |

| Considers various income streams |

5. VA Loans

Great for: Retirees who serve or have served in the armed forces

VA home loans are niche loans offered specifically to veterans and active military personnel. Private lenders who participate in the VA home loan program offer these loans, providing generous terms to help veterans and active military personnel own a home.

| Pros of VA Loans for Seniors | Cons of VA Loans for Seniors |

| No down payment requirements if you meet the eligibility criteria | Must meet VA service eligibility requirements |

| Competitive interest rates | Must have a funding fee |

| Easier qualification process | Purchased property must be a primary residence |

6. USDA Home Loans

Great for: Retirees who want to live in a rural area

USDA loans are niche loans designed to promote homeownership in rural areas. If you’re looking to retire in a rural area, these loans from private lenders offer generous benefits.

| Pros of USDA Home Loans for Seniors | Cons of USDA Home Loans for Seniors |

| No down payment if the property meets rural property requirements | Only available in designated rural areas |

| Lower income threshold than a conventional loan | Must meet income restrictions |

| Purchased property must be a primary residence |

7. FHA Loans

Great for: Retirees with lower credit but some savings

FHA loans are niche home loans offered by private lenders but insured by the Federal Housing Administration (FHA). If you default on your loan, the FHA will pay the unpaid principal to the lender, making it more appealing for lenders to issue mortgages to buyers with lower credit.

| Pros of FHA Loans for Seniors | Cons of FHA Loans for Seniors |

| Lower down payment requirement (3.5%) | Requires an upfront mortgage insurance premium (MIP) |

| Lower credit score requirements | Requires regular private mortgage insurance (PMI) payments as part of your monthly payment |

| Allows for various income sources | May have loan amount limits |

4 Other Homebuying Options for Seniors

Traditional mortgage loans aren’t the only homebuying options seniors can take advantage of, especially if you have a lot of equity in a current home. Depending on your situation, you may be able to purchase a new home in one of the following four ways.

HELOC or Home Equity Loan

Great for: Retirees looking to purchase a second home who already have equity in another home

Many recent retirees have built substantial equity in their family homes. Using existing home equity allows you to borrow against your home’s equity and bypass a mortgage loan altogether when purchasing a second home. It’s a good option for snowbirds who want to maintain their current home while purchasing a second home somewhere warmer.

| Pros of a HELOC/Home Equity Loan for Seniors | Cons of a HELOC/Home Equity Loan for Seniors |

| Flexibility to access funds as needed | Interest rates are variable so payments can fluctuate |

| Provides a lump sum for a down payment | Can be risky if you overspend because you can lose both homes |

| Only pay interest on what you borrow | Making two monthly payments (one for the home equity loan and the other for the second home) can be challenging for retirees on a fixed income |

Reverse Mortgage

Great for: Retirees with a small outstanding existing mortgage on their current home who wish to purchase a second home

A reverse mortgage is a niche mortgage loan that allows the homeowner to retain the title to their current home. The bank pays out a lump sum to the homeowner for the home equity. The homeowner does not need to make monthly payments towards the loan.

The homeowner (or their inheritors) only has to pay off the loan when they sell their home, move out, or pass away. However, all the interest and fees associated with the lump sum (which accrue monthly) are also due in full at that time.

One type of reverse mortgage is a home equity conversion mortgage. This is only offered to homeowners who are 62 or older.

| Pros of a Reverse Mortgage for Seniors | Cons of a Reverse Mortgage for Seniors |

| Access your current home’s equity | Limited access to cash over time |

| A good option for supplementing retirement income | Limits your heir’s inheritance by diminishing the equity of the home |

| No monthly payment | Potential to lose the home if you cannot pay property taxes |

| Significant closing costs and mandatory counseling sessions |

Buy a Home Outright

Great for: Retirees with enough cash to cover the entire cost of a home

Some seniors are fortunate enough to have significant savings or access to enough assets to purchase a new home in cash.

This is especially true for homeowners looking to downsize. When you sell your larger family home, if you have enough equity, you may walk away with enough proceeds to cover the cost of a smaller home in an active adult community. It’s important to consider all the pros and cons of paying in cash versus taking out a mortgage.

| Pros of Buying a Home Outright for Seniors | Cons of Buying a Home Outright for Seniors |

| No monthly mortgage payments | Requires significant upfront capital |

| Full equity of the home | Limits your ability to access the cash you used for other purposes |

| Peace of mind | Property taxes and maintenance costs must still be paid |

| A seller may be willing to negotiate for a lower sale price since close can occur faster | Interest on a mortgage payment is tax deductible, so you may owe more in taxes |

Buy a Home With a Cosigner

Great for: Retirees who can’t qualify for a loan on their own due to lack of income or a history of bad credit

You can also add a cosigner to any of the types of loans mentioned in this post. A cosigner agrees to be legally responsible for your debt if you cannot pay it. A co-signer often is a close friend or family member with better credit than you.

| Pros of Buying a Home With a Cosigner for Seniors | Cons of Buying a Home With a Cosigner for Seniors |

| May help you qualify for a lower interest rate than you could get on your own | May lead to conflict with your co-signer if you can’t make the payments or default |

| May allow for a lower down payment option |

3 Refinance Programs for Seniors

Some seniors may not be looking to move in retirement. However, they may want to refinance their existing mortgage for lower monthly payments or a lower interest rate. There are three popular refinance programs for seniors.

Rate-and-Term Refinance

Great for: Retirees looking to speed up their mortgage repayment or lower their monthly payments

A rate-and-term refinance replaces your existing mortgage terms with a new mortgage with a different rate or loan term to lower your monthly payment.

For example, you might refinance the remaining amount due on your mortgage at an interest rate two points lower than your current one and spread out repaying the remaining balance over another 30-year term to lower your monthly payment. You could also refinance your remaining balance with a 15-year term to pay off the loan sooner.

| Pros of Rate-and-Term Refinance for Seniors | Cons of Rate-and-Term Refinance for Seniors |

| Lower monthly payments can free up cash for other needs | You’ll have to pay closing costs upfront |

| Pay off your loan faster to build more equity in your home | You risk not qualifying for a lower interest rate |

| No impact on your current equity |

Cash-out Refinance

Great for: Retirees who want to cash out some or all of the equity of their home

A cash-out refinance replaces your existing mortgage with a new, larger loan in exchange for a cash payout from the bank. Use this cash payout for anything you like, from the down payment on a new home in an active adult community to a bucket list trip to Europe.

It’s similar to a home equity loan or HELOC. However, a cash-out refinance extends the life of your original mortgage and increases your monthly payment. In contrast, a home equity loan or HELOC creates an entirely separate loan. There are also no restrictions on what you can use the cash from a cash-out refinance for like there are with home equity loans or HELOCs.

For example, if you have $100,000 of equity in your home but still owe $200,000, you could do a cash-out refinance for $300,000 to receive a $100,000 payout in cash.

| Pros of Cash-out Refinance for Seniors | Cons of Cash-out Refinance for Seniors |

| Access to cash through your home’s equity | Higher loan amount and monthly payment |

| Potentially lower interest rate | Reduces your home’s equity |

| Risk of overspending |

Cash-in Refinance

Great for: Retirees with significant savings who want a smaller mortgage

A cash-in refinance involves paying a lump sum to reduce your loan balance. You are essentially “pre-paying” part of your mortgage to lower your monthly payment.

| Pros of Cash-in Refinance for Seniors | Cons of Cash-in Refinance for Seniors |

| Lower monthly payments | Requires a lump sum payment |

| Potentially shorter loan terms | Lost access to cash that you could use for other expenses |

Tips for Seniors Looking for a Mortgage

The decision to take out a mortgage isn’t one to make lightly. Carefully consider your options and take the time to speak to a financial advisor. When you do set out to take out a mortgage, consider the following tips.

Ensure the Benefits Outweigh the Costs

Moving to a new home in retirement has plenty of benefits, from helping you downsize to ensuring you live an active lifestyle surrounded by like-minded neighbors.

But there are also downsides. Closing costs and moving fees can add up, and there is currently a lot of debate around whether buyers’ commission changes are coming.

Before committing to a new retirement mortgage, consider whether the benefits outweigh the potential costs. The more prepared you are, the happier you’ll be with the outcome.

Plan Ahead To Improve Your Credit

On average, it takes a year or two to increase your credit score significantly, although it depends on the nature of your credit history. So check your credit score early in the process and start working to improve it immediately.

The most common ways to improve your credit include:

- Paying down debt

- Making payments on time

- Sticking to a budget

- Keeping your credit utilization low

Consider Loan Types Carefully

As you’ve already seen, each loan type is different, and what works for one person may not work for another. Consider the loan’s requirements carefully and choose what best suits your situation.

Consider estate planning in your decision-making because your loan may have estate implications. For example, if you take out a reverse mortgage, your inheritors will be responsible for paying back the loan and all relevant fees and interest, which they may only be able to pay with the equity from your home.

Understand Your Income

Retirement income streams aren’t always as straightforward as employment income streams. Often, you’ll have several sources of income, from Social Security to pension payouts to retirement disbursements.

To make it easier, gather information about your income early and keep two months of documentation for each.

Find Your Perfect Place With 55places

Getting a home loan as a senior may be easier than you think. Explore all the loan types available and make the best choice for your unique needs.

As you start considering a mortgage, be sure to consult 55places to help you find the perfect 55+ community for you. Our 55+ Monthly Housing Market Trends can help you find the best time to buy and estimate sales prices. Partner with one of our agents to find the perfect home for your retirement!

FAQ

Learn more about getting a mortgage while retired.

Which Type of Mortgage Is Typically Offered to Seniors?

A reverse mortgage is often specifically marketed to seniors so they can access the equity in their home in a lump sum from their lender. However, there are a lot of pros and cons of reverse mortgages to consider with this type of mortgage, and it isn’t for everyone.

Can a Senior Citizen Get a Home Loan?

Senior citizens can get a mortgage if they meet the income and credit requirements to do so. The Equal Credit Opportunity Act prohibits lenders from denying a person a loan based on age.

Which Loan Program Is Only Available to Homeowners Who Are 62 or Older?

Home Equity Conversion Mortgages (HECM), a type of reverse mortgage, is only offered to homeowners older than 62. Homeowners 55 and over may qualify for Fannie Mae or Freddie Mac senior home loans.

All other home loans are not restricted by age.

What Is the Oldest Age You Can Get a Mortgage?

As long as you can prove a steady income and meet the mortgage loan’s requirements, anyone can qualify for a loan, even if they’re over 100!

Can a Retired Person Get a FHA Loan?

Retired people can get an FHA loan if they meet the lenders’ requirements.

Can You Get a Mortgage With Only Social Security?

It is possible to get a home loan for seniors on Social Security. However, it depends on your income, debt-to-income ratio, and credit score. You can get a mortgage as long as your Social Security income is high enough to meet the lender’s income requirements and you meet all the other criteria.