The 55+ real estate market is constantly shifting between two key conditions: a buyer’s market and a seller’s market. Understanding where the market stands can help 55+ homebuyers secure their ideal home at a competitive price.

In a buyer’s market, conditions favor homebuyers, giving them greater purchasing power. Key indicators of market trends include inventory levels, the number of days listings remain on the market, and fluctuations in home prices.

At 55places, our mission is to help active adult homebuyers find the best opportunities in 55+ communities. We provide the most up-to-date, comprehensive data on market trends. Using our market insights tool—which combines expert knowledge with real-time MLS data—we’ve identified the top buyer’s markets for purchasing a home in a 55+ community right now.

What Is a 55+ Buyer’s Market?

The underlying principle that affects all economic markets is “supply and demand.” Prices change based on the availability of a good and the desire for it. Simply put, when supply is high and demand is low, prices go down. This basic economic model also defines the conditions for a real estate buyer’s market.

This leads us to our key indicators for identifying a buyer’s market:

- High months of inventory – “Months of inventory” refers to how long it would take to sell all available home listings at the current pace of sales in a given market. A high number in this category indicates a surplus inventory of homes and gives us the supply part of the model.

- Longer days on market – “Days on market” measures the median number of days that homes are listed for sale before the seller accepts an offer or takes the property off the market. Many days on the market indicates low demand and less competition for homebuyers.

- Stable or declining prices – Pricing is the final part of our supply and demand equation. If real estate prices begin to level off or start to decline, it’s a strong indicator that the inventory of available homes is greater than the number of homebuyers.

We’ve combed through our data with an eye on these indicators to identify the current top buyer’s markets in the U.S. If you’re an active adult homebuyer looking to make the most of your budget, it may be time to tour a 55+ community in one of these markets.

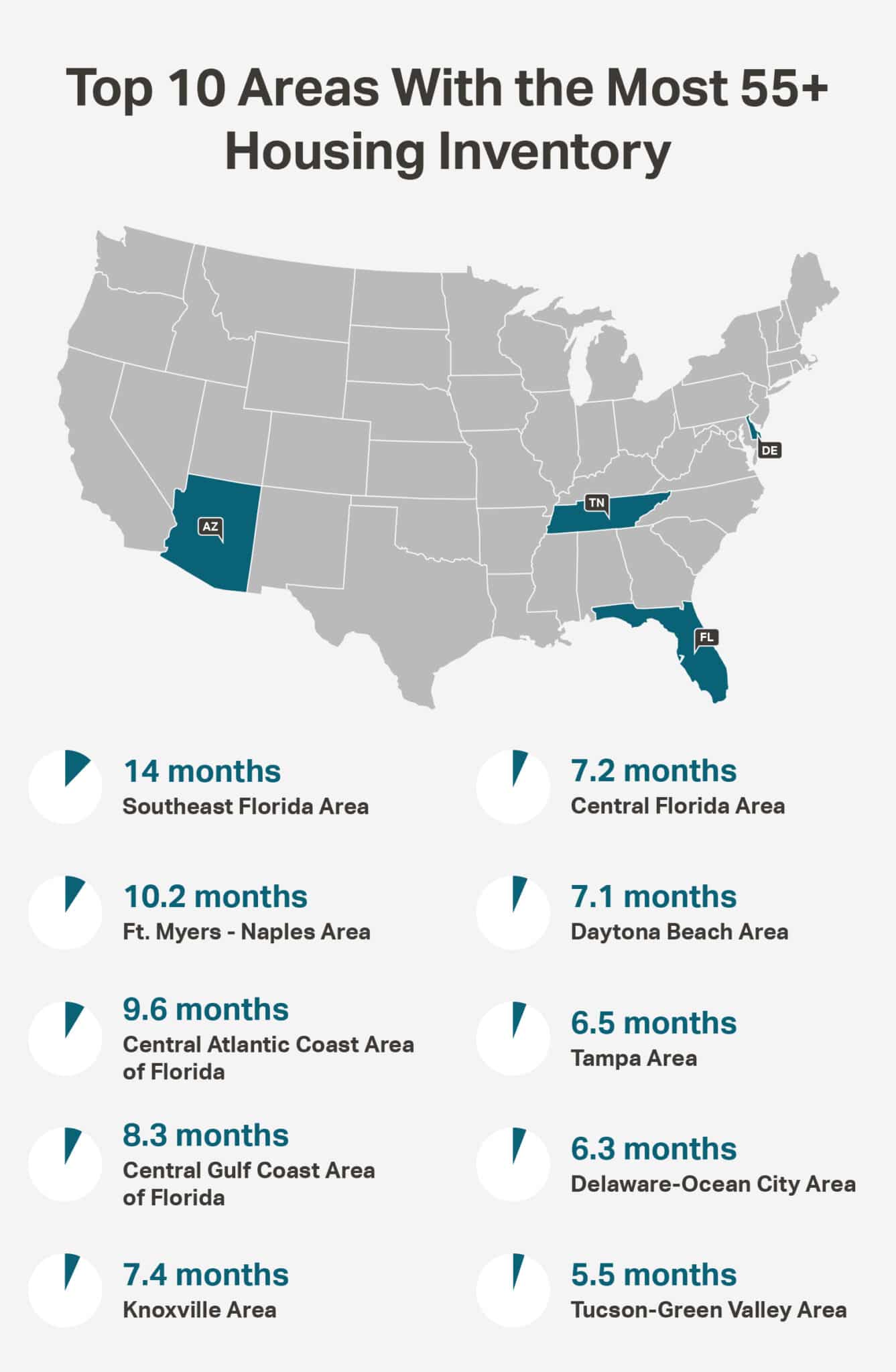

Top 10 Areas With the Most 55+ Housing Inventory

Inventory plays perhaps the most important role in shaping market conditions in favor of homebuyers. High inventory means that buyers have more choices when it comes to location and home features. There’s also less competition from other homebuyers, which is ideal because a competitive market can lead to bidding wars and pressure to make hasty decisions.

High inventory in a buyer’s market also gives buyers more negotiating power. Many things are up for negotiation when buying a home. For example, sellers are more likely to reduce prices, cover various costs and fees, or agree to repairs to entice a sale in a buyer’s market.

Here are the top 10 areas with the highest months of inventory (MOI) in 55+ communities right now:

1. Southeast Florida Area

MOI: 14 months

Florida has the most 55+ communities in the country and the highest current MOI. Compared to this time last year, the inventory has doubled in Southeast Florida. This part of the Sunshine State is a big draw for active adults thanks to a warm and sunny climate, access to major cities like Miami and Fort Lauderdale, and plenty of tax advantages for retirees.

2. Ft. Myers-Naples Area

MOI: 10 months

Situated along the coast, the Fort Myers–Naples area is a great choice for retirees who want to spend their days fishing, boating, and golfing. This market also benefits from affordable homes, and with plenty of inventory on the market currently, prices are even lower.

3. Central Atlantic Coast Area of Florida

MOI: 9 months

Centered around Port St. Lucie, the Central Atlantic Coast Area of Florida provides all the benefits of a Florida retirement in a more relaxed, quiet environment that has a small-town feel with plenty of big-city amenities.

4. Central Gulf Coast Area of Florida

MOI: 8 months

In addition to a rich cultural scene and plenty of opportunities for warm-weather recreation, the Central Gulf Coast Area of Florida also has a lower cost of living than most other areas of the state, providing plenty of reasons to buy a home in a 55+ community here.

5. Knoxville Area

MOI: 7 months

The Knoxville Area treats residents to urban amenities in a scenic location among the Great Smoky Mountains. Even though the region experiences all four seasons, the weather is mild throughout the year, and Tennessee has a low cost of living, making for an ideal retirement destination.

6. Central Florida Area

MOI: 7 months

The Central Florida Area has probably the most diverse range of living environments in the state. With Orlando’s metropolitan excitement and Ocala’s natural splendor, there’s something here for all walks of life.

7. Daytona Beach Area

MOI: 7 months

Daytona Beach and its surrounding areas provide access to numerous beaches and plenty of cultural attractions, with a lower cost of living compared to other coastal retirement destinations in Florida.

8. Tampa Area

MOI: 6 months

Tampa and its namesake bay make for scenic waterfront living along Florida’s Gulf Coast, making it a popular retirement destination for active adults who enjoy aquatic recreation.

9. Delaware-Ocean City Area

MOI: 6 months

Last year Delaware was named the number one state for retirement in the U.S. due to its high quality of life, temperate four-season climate, and tax friendliness. And now, with a buyer’s market, it’s an even more attractive destination for 55+ homebuyers.

10. Tucson-Green Valley Area

MOI: 5 months

With abundant sunshine, a desert climate, and cooler temperatures than the rest of Arizona thanks to its higher elevation, the Tucson area is a top retirement destination in the Southwestern states.

Top 10 Areas Becoming a 55+ Buyer’s Market

As we mentioned earlier, real estate markets are always in flux. By monitoring data trends, it’s possible to identify areas that are in the process of shifting toward a buyer’s market. This allows homebuyers to get in early to seize the best opportunities to purchase a home in a 55+ community at a great price.

Here are the top 10 emerging 55+ buyer’s markets compared to this time last year:

1. Southeast Florida Area

Active listings in 55+ communities are up 43.9%, with homes staying on the market for a median of 80 days, which has driven closing prices down 11%.

2. Central Atlantic Coast of Florida

With 53.8% more active listings in 55+ communities, listing prices have dropped 10% this year.

3. Knoxville Area

Active listings in 55+ communities have doubled in the Knoxville market, the highest increase percentage-wise of any in our list, with homes spending a median of 82 days on market.

4. Central Florida Area

Active listings in 55+ communities are up 37%, with over 3,000 homes on the market. This is second in total numbers only to Southeast Florida.

5. Daytona Beach Area

In the Daytona Beach market, active listings in 55+ communities are up 29%, and closed listings are down 15%, which has caused prices to stabilize.

6. Tampa Area

Homes in the Tampa area spend a median of 75 days on the market. And with 28% more active listings in 55+ communities, it has decreased closing prices by 7%.

7. Delaware-Ocean City Area

There are 48% more active listings in 55+ communities. Homes in these communities are on the market for a median of 77 days, which has caused prices to stabilize.

8. Atlanta Area

Prices have also stabilized in the Atlanta area due to a 31% increase in active listings in 55+ communities with a 16% decrease in sold homes.

9. Austin Area

Austin has seen a major 16% decrease in closing prices in 55+ communities, likely due to listings reaching a current average of 114 days on the market—the highest on our list.

10. Houston Area

Although not as drastic as the rest, the Houston area is also trending toward a buyer’s market with stable prices and a 19% increase in active home listings in 55+ communities. Homes in these communities spend a median of 50 days on the market.

Connect With a Local 55+ Real Estate Agent Today!

If you’re looking to purchase a home in a 55+ community, keep a sharp eye on the real estate markets. With high amounts of inventory and lower prices driven by market trends, these areas provide some of the best opportunities right now to find a great home at an affordable price. Also, by taking advantage of a buyer’s market, you will have greater buying power and an upper hand in negotiations.

If you want to learn more or need help seeking out these great opportunities in your preferred market, contact 55places and we’ll connect you with a local real estate expert today!

Methodology

We analyzed data from over 70 Multiple Listing Services (MLSs), focusing on home sales in 2024 and 2025 within the geographic boundaries of more than 2,500 active adult communities listed on 55places.com. Most of these communities are age-restricted for residents 55 and older, in accordance with the Housing for Older Persons Act. We also included a small number of age-targeted communities—those designed to appeal to 55+ residents through their home designs, amenities, and lifestyle offerings, despite lacking formal age restrictions.

For each community, we aggregated key metrics, either summing or averaging values, to reflect trends within the broader “Area” they belong to.

While our methodology provides a comprehensive market overview, it does not account for transactions occurring outside the MLS. This includes many new construction home purchases made directly from builders, as well as private sales between friends or family members. Additionally, we excluded outliers to ensure the data remains relevant to the 55+ homebuying market.