When it comes to retirement, it’s hard to beat the sunshine, lifestyle, and ease of living that Florida offers.

The Sunshine State continues to claim the top retirement spot in surveys by Kiplinger and other similar sources. It’s not difficult to understand why: There’s abundant sunshine year-round, golf in February, and a lack of winter coats and boots. Florida also has no state income tax, a high quality of life, and endless opportunities for recreation and entertainment. The cost of living has risen, but it’s still much lower than in many areas in the country. And when it comes to finding a home, 55+ communities are all over the state, from coastal cities to Central Florida towns.

Florida by the Numbers: A Retirement Demographic Snapshot

According to Census.gov, the population of Florida is over 23 million. Nearly 22% of that population is 65 years of age or older. The median age of a Florida resident is 42.6 years, making this one of the oldest states in the U.S. by demographics. Also, the recent Florida State Plan on Aging says that more than 5.5 million Florida residents are at retirement age. By 2045, retirees will likely increase to 8.4 million, or over 30% of the state’s population.

The Rise of 55+ Communities in the Sunshine State

To meet this growing population and its housing demands, Florida has seen an increase in the construction of 55+ communities. There are more than 1,300 retirement and active adult communities throughout the Sunshine State. Some are large, well-known brands such as The Villages and On Top of the World. Others are smaller, more intimate neighborhoods. The average price of a home in one of these communities is $360,000, according to 55places.com data.

Planning Your Florida Retirement: Where to Begin

A Florida retirement might seem like the best way to go, but making plans can quickly become overwhelming. Where should you live? What about health care? How real is the hurricane threat? To answer all your questions, we’ve created the ultimate starting point for anyone considering retirement in Florida.

This is a comprehensive, one-stop shop for all things Florida and retirement. Find everything you need to plan for housing, cost of living, and lifestyle. Also, if you’re already making good progress with your retirement plans but you’re stuck on something in particular, we’ve anticipated that. There are user-friendly links in each section for more specific, in-depth resources.

This is a guide for anyone newly retired or planning a retirement in Florida. We’re here for active adults and anyone planning ahead. Not retiring for another decade? Maybe this is how you decide which part of Florida to retire to. Whether you’re a part-time snowbird considering a full-time move or an out-of-state buyer eager to find lower taxes and low-maintenance living, you’ll find some support here.

Let’s take a look at the reality of a Florida retirement!

Why Retire in Florida?

Floridians spend a lot of time outdoors. The lifestyle in the Sunshine State is all about that: the sunshine. Imagine long walks on the beach, lazy weekends spent on a lake, lots of golf, plenty of hiking, and (of course) outdoor tables when popping into a restaurant for brunch or dinner. Also, lots of 55+ communities have pools for swimming and lounging.

When Did Florida Become the Retirement Place to Be?

People of retirement age began migrating to Florida in the middle of the 20th century. After the end of World War II, there was a period of prosperity and an expansion of the Social Security system. Pensions became more generous, and a cultural shift towards leisure and freedom took hold. Florida began welcoming a large influx of retirees. As the decades moved on, development began on more and more 55+ communities up and down the coasts and even into Florida’s central cities.

Some of the original communities, such as The Villages and Sun City Center, are still seeing growth today. From the 1970s to today, retirement in Florida has become accessible to more people. And most recently, as remote work has normalized over the last decade, people can get a head start on their retirement plans without even leaving their jobs.

Benefits to Retirement in Florida: A Quick Look

A lot of other states are working hard to attract retirees. We see you, Arizona. We’re watching you, Nevada. Even the Carolinas are trying to get in on the retiree relationship. Florida is special, however, and a lot of people cannot imagine retiring anywhere else. It’s easy to understand why.

1. Warm Weather and Water

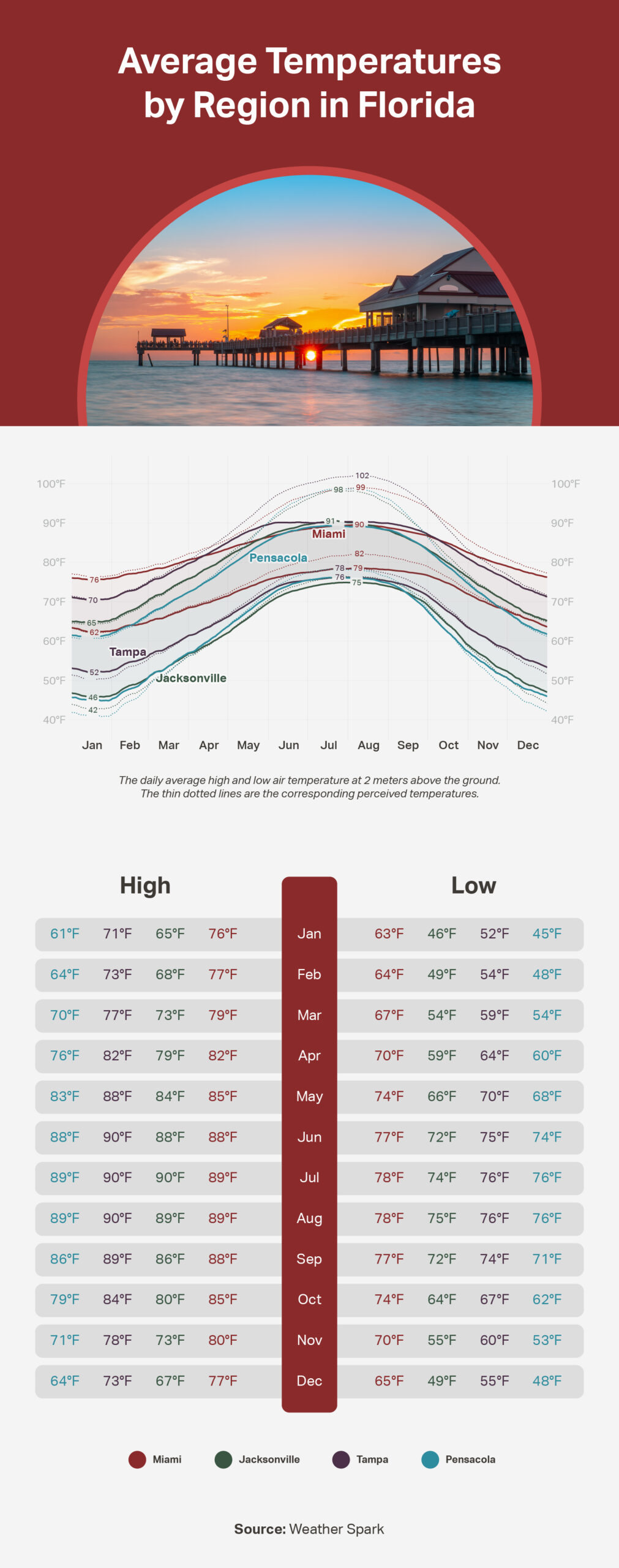

Summers are long and hot, but if you’re on the coast, there’s always a breeze. If you’re inland, you’ll likely enjoy cooler evenings and skies full of stars. Average summer temps in South Florida hover around the upper 80s during the day and the low to mid 70s at night. Central Florida averages tend to creep up to the low 90s during the day, and there’s a lot of humidity. Along the Gulf Coast, average temps are in the low 80s to low 90s. At night, it doesn’t get much cooler than the mid-70s. Northern Florida is much cooler. The Panhandle, Jacksonville, and even inland northern cities like Gainesville see summer averages in the 80s.

Winters are mild. In fact, the air conditioner will run more days than the heating does. Daytime averages are in the 60s and 70s. In the evenings, North Florida gets chilly. Plan to cover your outdoor plants from time to time if you’re living in Jacksonville or St. Augustine. The rest of the state won’t go lower than the mid-40s to mid-50s at night in general, except for a few freak overnight temperatures that drop towards freezing.

Some residents stay just for the winter, preferring to be out of the state when the sticky summer rolls around. This is understandable, but those long summer days can be enjoyable. The benefits of full-time Florida retirement living include a strong sense of community, a lot of fresh fruits and veggies from the statewide agricultural system, and resident discounts at state parks, museums, theme parks, and golf courses.

2. No State Income Tax

Taxes are as low as the chance of snow in Florida. There’s no state income tax, so you don’t have to file a state tax return. There’s also no estate tax, nor is there an inheritance tax. This leaves residents with more of their social security income, pension income, and investment income.

3. Active Lifestyle and 55+ Communities

Active adults gravitate towards 55+ communities because they provide many amenities, features, and opportunities for social connections and physical fitness. There are often several floor plans and home models to choose from, customizations that can easily be made to any new home, and a social calendar full of events such as wine tastings, card games, fitness classes, and other clubs and activities.

“We’ve seen a growing number of retirees looking not just for a home, but for connection and community. Florida continues to deliver that in a way few other states can.”

Retirees are also attracted to the low-maintenance lifestyle that these communities can provide through hands-on homeowner’s association (HOA) management. No one wants to spend their retirement mowing the lawn or cleaning the pool. Many of these communities are gated and secure, and the strong sense of belonging leaves residents feeling supported and happy.

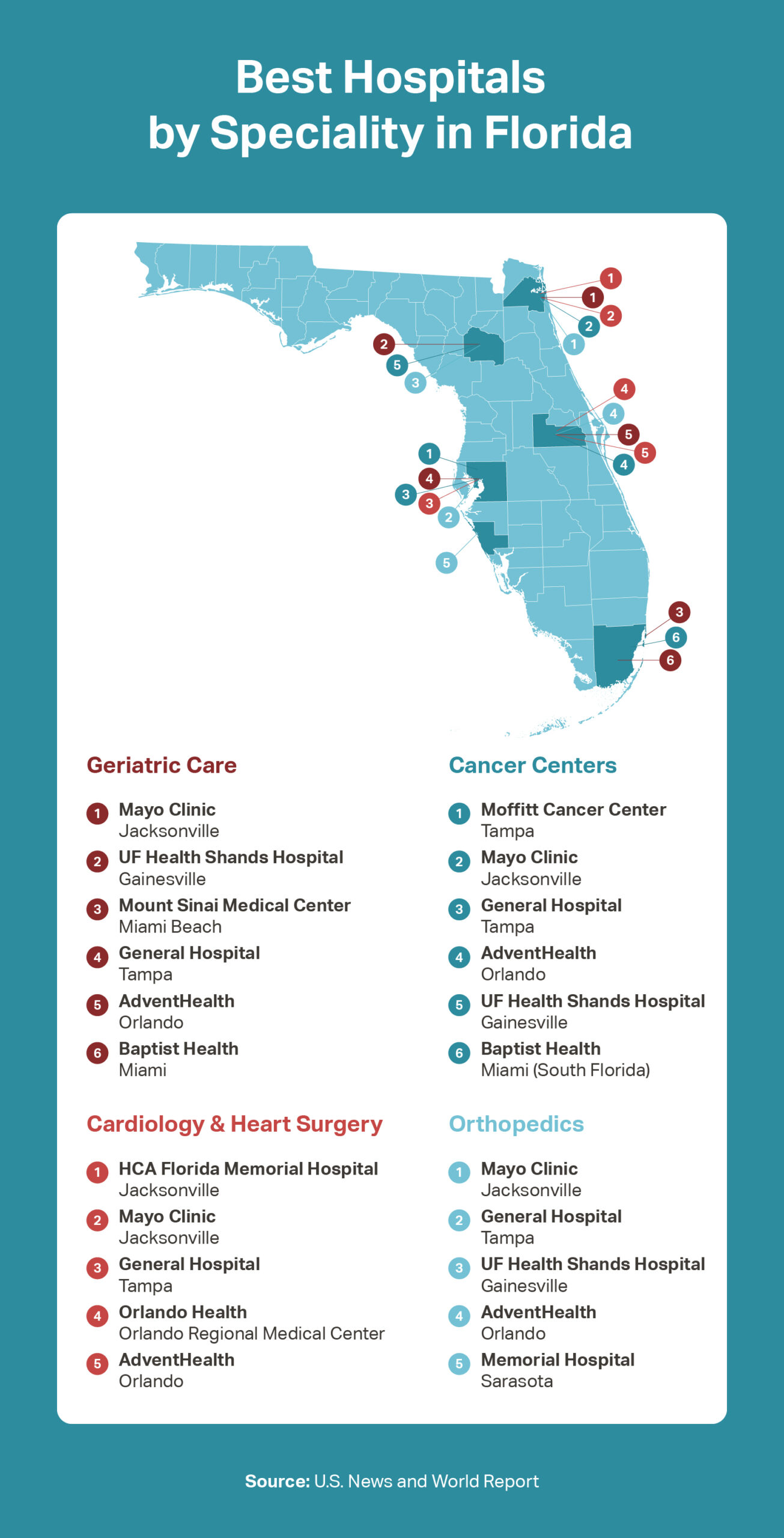

4. Elite Health Care Infrastructure

It’s impossible not to think about health as retirement age approaches. In Florida, there’s a strong health care infrastructure that supports everything from cancer treatment to heart health to weight management, mental health, and preventative medicine. Top-rated hospitals in Florida include Mayo Clinic in Jacksonville, Cleveland Clinic in Weston, and Moffitt Cancer Center in Tampa.

Senior health care is a focus in hospitals and medical centers across Florida, particularly in cities where retirees tend to settle, such as Sarasota and Naples. In Florida, Medicare Advantage plans, also known as Medicare Part C, are offered by private insurance companies and often offer extra benefits like dental, vision, and hearing coverage. Some include prescription drug coverage (Part D). There are over 600 plans available, and the average cost is under $5.00, according to The National Council on Aging.

Florida’s 55+ communities love wellness and preventative care. Many of these communities have fitness centers, yoga studios, and group exercise classes (some of them in the water). There are also plenty of holistic and integrative centers found in most cities, rehab facilities, and community health centers to help with things like vaccinations and urgent care needs.

Cost of Living & Taxes

Florida’s cost of living has increased over the last five years. This is due to inflation as well as a much higher demand for housing and other resources in Florida. The growing population (an influx of not only retirees but also remote workers and new residents) has caused prices to jump in a lot of cities across the state.

According to Best Places, comparing Florida’s cost of living to the national average depends on whether you’re living in Florida on your own or with a family. For a family, living in Florida is 3.1% more expensive than the national average. For a single person, the cost of living in Florida is pretty much the same as the national average.

Remember that not only does family size matter, but also specific geographical regions. The cost of living in Miami or Naples is much higher than what should be expected in Jacksonville or Ocala.

Housing Affordability and Retirement in Florida

Anyone planning to buy a home for their Florida retirement can plan to spend as little as $100,000 on a modest condo or several million dollars for waterfront property. It depends on what type of home you desire and where in Florida you want to live. Current data from the National Association of Realtors says that the average home price in Florida hovers at just over $430,000. That’s slightly higher than the national average, which is about $400,000 in February of 2025.

For 55+ homeowners, there’s often more value to be found in active adult communities. Currently, the average price of a home in a 55+ community in Florida is $360,000, according to 55places.com data. There’s also more included in these home purchases. HOA fees will often cover landscaping and lawn care. Sometimes, even the trash, internet services, and water bills are rolled into the HOA fee. Plus, the community amenities mean that residents don’t have to pay for things like gym memberships or yoga classes.

“Florida’s retirement appeal goes beyond palm trees and warm winters. Today’s retirees are looking for walkability, wellness, and community engagement, and Florida’s 55+ developments are designed with those priorities in mind.”

-Khadeejah Johnson, Associate Vice President of Brokerage & Partnerships at 55places.com

Homeowners’ Insurance Costs in Florida

Homeowners’ insurance must be considered as well when budgeting for a Florida retirement. According to Nerd Wallet, the average cost of homeowners insurance in Florida is $2,625 per year—24% more than the national average. That number can be higher for homeowners with low credit scores.

Hurricane risks tend to push insurance premiums higher. The Florida Department of Financial Services offers homeowners many insurance resources, specifically related to hurricane coverage, deductibles, and claims.

Active Adult Rental Costs in Florida

For active adult renters, 55+ communities across the state are not only more affordable in general, but also professionally managed. That means maintenance is included and onsite, landscaping is taken care of, and amenities are well-maintained.

Renting can be an excellent option, especially for retirees who are not sure where they want to be. A rental home provides more flexibility, freedom of movement, and gives new residents the time and space to decide where they want to live when it’s time to buy. Rental communities are also popular among snowbirds who only spend four to six months of the year living in Florida.

Average Utility Costs in Florida

The data from Move.org says that U.S. households spend an average of about $380 per month on essential utilities such as electricity, natural gas, water, and sewer. When you include internet, phone, and streaming services, that total rises to $583 per month. Currently, the average total utility cost in Florida is $521.

Keep in mind: Utility bills tend to spike across the state when summer rolls around and air conditioning is needed 24 hours a day. It’s rarely cold enough to need heat in the winter, unless you’re in north Florida during a cold spell, so expect utility costs to vary by season.

Transportation Costs in Florida

A study from Money Digest says that owning a car in Florida comes with the following average costs:

- $2,248 per year on gas

- $2,694 per year for insurance

- 6% sales tax due on a new vehicle purchased in Florida

The no-fault insurance laws in Florida and the high number of uninsured drivers generally keep insurance rates high. But many insurance providers offer discounts for seniors and retirees, especially those with good driving records.

Public transportation can be limited in Florida. Bus and transit systems are more sophisticated in cities such as Miami, Jacksonville, Tampa, and Fort Lauderdale. Many of the 55+ communities throughout the state offer shuttle services and plan group trips to grocery stores, malls, and restaurants. For anyone planning a retirement in Florida without a car, those are the communities to target when it’s time to decide where to live. Some of the more notable neighborhoods include Latitude Margaritaville in Daytona Beach and Lauderdale West in Plantation.

Food Facts: Groceries and Dining

Groceries

According to the data shared by Instacart and the USDA, the grocery budget for a single person could be as low as $315 a month and as high as $525 per month. For a couple, that average gets close to $1,000 per month. The grocery store chains that residents will find here include Publix, Winn Dixie, Whole Foods, ALDI, Walmart, Sprouts, Trader Joe’s, and The Fresh Market.

Here’s a fun fact: Florida’s banana prices are the cheapest in the U.S.

Dining

For active adults who enjoy dining out, Florida has a range of restaurant prices. At a casual sit-down restaurant, a meal could be between $15 and $25 per person. Upscale dining may come with a price tag of $50 to $100 per person. In tourist areas such as Orlando, restaurant dining can be a bit pricier because of vacationers.

The good news is that a lot of restaurants will still have early bird or happy hour specials, especially restaurants near 55+ communities. Show up between 4:00 p.m. and 7:00 p.m., and you’re likely to find a deal. Check the menus for senior discounts too.

Retirement in Florida and Taxes

If you’re considering a Florida retirement, you likely know that the Sunshine State has no state income tax. You’ll have to continue paying federal taxes, of course, but Social Security benefits, pensions, 401(k) and IRA disbursements, and other types of income are not touched at the state level.

Meanwhile, in California, retirees could pay up to 12-13% of their income in state taxes. In New York, the state income tax rate is 10-11%, depending on income. Florida is one of the most tax-friendly states in the U.S., especially for retirees.

There’s also no estate tax. No inheritance tax, either. This helps residents to preserve generational wealth and avoid additional taxation on assets that are passed down from a family member.

Florida Property Taxes

Property taxes come with a Homestead Exemption in Florida for full-time residents. Property taxes can be reduced by up to $50,000 when your home here is a permanent residence. Here’s how this looks in practical terms:

- Let’s say you buy a property that’s valued at $300,000.

- You qualify for a Homestead Exemption of $50,000.

- The taxable value of your home is reduced to $250,000.

Property taxes vary by county, but we’ll use an example of 1.5%, which is comparatively high for Florida. After the Homestead Exemption, with the $250,000 market value being used for tax purposes, the total paid in property taxes is $3,750 instead of $4,500, which is what would have been paid without the exemption. That’s an annual savings of $750.

There’s also the Save Our Homes Cap. For retirees who have lived in their Florida home for several years, this cap can lower their taxable value even further by limiting annual increases in the home’s taxable value to 3% or the Consumer Price Index, whichever is lower.

Using the same example, if your home is appraised for $300,000, and the market value rises 10% one year, under the Save Our Homes cap, the taxable value may only increase by 3%. This means you could avoid paying higher property taxes even as the value of your property increases over time.

Where can you find the lowest property tax rates in Florida? According to 2024 data, these are the counties with the lowest property tax burdens. However, these are rural parts of Florida, surviving mostly on an agricultural economy.

- Dixie County ($503 average)

- Holmes County ($555 average)

- Jackson County ($630 average)

- Hamilton County ($668 average)

- Washington County ($687 average)

- Levy County ($735 average)

- Walton County ($861 average)

- Gilchrist County ($867 average)

Additional Resources:

- How Much Does It Cost to Retire in Florida?

- Understanding Florida Homeowners Insurance: Where to Expect and How to Prepare

- 55+ Communities in Florida With Homes for Sale Under $100k

- The Best Lowest-Priced Communities in Florida

- 10 Gated Communities for Florida Retirees on a Budget

- The Most Affordable Retirement Communities in Florida

Climate and Weather

Florida has a reputation when it comes to weather, and there’s a good reason to imagine that it’s always hot and sunny, save for the occasional hurricane.

But there’s more diversity to Florida’s weather than most people realize. North and Central Florida enjoy a humid subtropical climate, which comes with long, humid summers and mild, cool winters. South Florida, which is everything from Lake Okeechobee down to Miami and into the Keys, is a tropical climate. If that’s where your Florida retirement takes you, expect warm temperatures year-round and a lot of rain.

The sunshine all year long is a big bonus for people who retire to Florida. Golf and boating never falls out of season. Coffees and cocktails can be enjoyed on patios and rooftop bars whether it’s January or June. The population of the state swells during the winter months as part-time residents escape the snow and cold. This is one of the main reasons why retirement in Florida is so attractive to people from the North, the Midwest, and even Canada.

Average Temperatures by Region

Even with abundant sunshine and dry winters, things feel a bit different in Tallahassee than they do in Orlando. Let’s take a look at where the average temperatures land in different parts of the state.

The Sunshine State

Let’s talk about the sunshine. On average, there are 237 sunny days per year in Florida. Some say Fort Myers is the sunniest city in the state. Key West and Miami rank pretty high too. The amount of sun will generally depend on the season and whether your Florida retirement takes you to the coast, which can have a marine layer, or inland Florida, where the sun can be particularly intense.

“We talk to buyers every day who say the same thing: they want less stress and more sunshine. Florida offers that balance with the added bonus of world-class health care and no state income tax.”

-Bill Ness, Chief Executive Officer, Founder, & Illinois Managing Broker at 55places.com

The constant sunshine means plenty of Vitamin D and outdoor recreation, entertainment, and dining. There’s more time to spend in the garden or the pool. All that sun also means better health. According to the University Medical Center of New Orleans, spending time in the sun boosts your mood. It also contributes to better bone health, better sleep, and improved mental health.

How to Handle Hurricanes

Retirement in Florida means exposure to tropical storms. If you’re moving from an area that isn’t prone to hurricanes and dramatic rains, this could take some getting used to. The hurricane season officially starts on June 1 and continues through November 30. Peak activity tends to occur during August, September, and sometimes October. The worst of the recent storms struck Florida in September.

Fortunately, hurricanes can be anticipated. There are usually several days to prepare, and those preparations should always include:

- Fill your car with gas.

- Stock your kitchen with bottled water and non-perishable foods.

- Make sure you have batteries, flashlights, and candles that are easily accessible.

- Ensure you’re not running low on pet food or medications.

- Bring in the patio furniture.

- Know what evacuation zone you’re in. (If an evacuation order comes, take it seriously.)

The Florida Division of Emergency Management has a comprehensive hurricane advisory system, complete with updates on tropical storm and hurricane watches, warnings, and advisories issued by the National Hurricane Center (NHC). There’s an app and a website that includes emergency checklists and the latest tropical information.

Have the Right Insurance

Before you start your retirement in Florida, make sure you have the right insurance for the home you buy. Flood insurance is separate from your regular homeowner’s policy, and your lender will likely require it if your home is in a flood zone.

Preventative Home Safety Features

When buying a home or updating the home that you’ve purchased, consider installing preventative safety features such as hurricane shutters, impact-resistant windows, polycarbonate panels, storm panels, and hurricane fabric screens. All of these things can lessen the damage that’s done to your property if a hurricane comes through.

While coastal areas are most at risk for direct hits, that doesn’t mean inland communities such as The Villages and communities in Ocala can feel unaffected. While the threat is not as severe as it is on the Gulf or the Atlantic coast, Orlando suffered serious damage in 2022 with Hurricane Ian and Hurricane Nicole. In 2004, there was massive flooding in Central Florida from a quick succession of storms; Hurricane Charley, Hurricane Frances, and Hurricane Jeanne. Preparation and vigilance are required throughout the entire state.

Additional Resources:

- The Best Places To Retire in Florida Without Hurricanes

- Weathering the Storm: Does an HOA Cover Hurricane Damage?

- The Most Affordable Places to Snowbird in Florida

- Fresh Alternatives to Florida for Retirement

Health Care and Senior Services

Florida’s large retiree population means that quality health care is in high demand. Florida has approximately 300 hospitals in the state, and more than 350 outpatient clinics. The Florida Department of Health was the first accredited public health system in the U.S. It oversees many services, including cancer prevention and care, women’s health, and support for people with disabilities. They also administer the Florida Community Health Assessment and Resource Tool Set, or CHARTS, which tracks some interesting statistics, such as:

- In Florida, the physician-to-population ratio is approximately 2.6 physicians per 1,000 people.

- Florida has 91,269 licensed physicians.

- The top three specialty groups for physicians providing direct patient care in Florida are internal medicine (28% or 16,011), family medicine (14.7% or 8,386) and pediatrics (8% or 4,550).

- Primary care physicians account for 31.5% of physicians providing direct patient care.

Also, according to the U.S. Census, 21.5% of Florida’s population is 65 years of age or older.

Florida’s Best Hospitals

U.S. News & World Report has done an excellent job of ranking Florida’s major hospitals. The most notable providers are:

- Moffitt Cancer Center – The main hospital is in Tampa, but there are a total of six locations around the state. They specialize in cancer treatment and prevention, including clinical trials.

- Mayo Clinic in Jacksonville – This hospital is nationally ranked in 10 specialties, including cancer, cardiac care, diabetes, and geriatrics. It’s also a teaching hospital.

- Tampa General Hospital on Davis Island in Tampa – This is a general medical and surgical facility as well as a teaching hospital. The geriatrics department is ranked highly.

- UF Shands Hospital in Gainesville – Affiliated with the University of Florida, this health care center includes expertise in cancer and rehab medicine. It’s highly ranked for orthopedics, lung surgery, and urology.

- Advent Health in Orlando – Formerly known as Florida Hospital, this hospital is nationally ranked for diabetes and endocrinology, as well as neurology and neurosurgery.

Medicare for Florida Retirement

Your retirement will likely include a Medicare plan of some sort. Basic Medicare coverage includes Part A and Part B, which together provide general health insurance for people 65 years of age or older. Also, most people don’t pay a premium for Part A if they or their spouse paid Medicare taxes while working. Part A covers:

- Inpatient hospital care

- Skilled nursing facility care (not custodial or long-term care)

- Hospice

- Some home health services

Part B helps pay for outpatient services such as:

- Doctor visits

- Preventive care

- Lab tests

- Mental health care

- Durable medical equipment

- Some home health services

Retirees usually pay a monthly premium for Part B, which may vary based on income. Given the large population of residents over 65 years of age, it comes as no surprise that Florida has a high enrollment rate and well-established provider networks for Medicare beneficiaries. Finding a doctor who accepts Medicare is not an issue in most cities throughout the state.

Medicare Advantage

While Medicare covers many essential health services, it doesn’t include most prescription drugs, dental, vision, or long-term care, so many retirees in Florida consider additional coverage through Medicare Advantage (Part C) or a Part D drug plan.

Medicare Advantage is widely used in Florida. With the large retiree population, insurance providers are actively marketing their plans, giving residents an impressive range of bundled choices that come with competitive premiums. Some policies have zero-dollar monthly costs. There’s also a continuity of care to these plans. Retirees are attracted to the convenience of managed care through provider networks. Some plans come with extra perks like gym memberships and transportation services.

Enrolling in the right plan and finding the right providers ahead of your Florida retirement is as easy as visiting the Medicare website, where there are lots of resources and plan descriptions. Another great resource for retirees is Serving Health Insurance Needs of Elders (SHINE). They frequently host virtual Medicare classes and provide information about aging and the support that is available in Florida.

Staying Healthy and Active

Preventive care is a priority for many active adults who are planning their retirement in Florida. Active aging is something that Florida supports, and many of the 55+ communities across the state hire lifestyle directors and implement wellness activities and amenities to help their residents stay physically and socially active.

It’s more than just fitness centers and yoga studios. It’s creating a sense of community. When friends and neighbors are getting together to walk community trails, take a pickleball class, or join a golf league, staying healthy isn’t a chore–it’s fun!

Support for Preventive Care

Many Medicare plans offer the Silver Sneakers benefit, which allows plan participants to take exercise classes online or in person at select gyms and fitness centers. In addition to live classes and workshops, there’s an entire library of on-demand lessons.

Also, community health screenings are popular in Florida and can frequently be found at 55+ communities or local health clinics. Providers can screen for:

- Skin cancer

- High blood pressure

- Diabetes detection

- Body Mass Index (BMI)

- Cholesterol

- Vision and hearing

- Breast cancer

- HIV testing

- Mental health testing

- Functional health and flexibility

Risk assessment leads to early intervention, which leads to better chances of recovery and disease management. Many health plans must cover a set of preventive services at no cost when delivered by a doctor or other provider in your plan’s network. In Florida, it’s also easy to contact the local health department or your health insurance plan for more specific information on available screenings and eligibility requirements.

When considering a home in a 55+ community, ask about wellness activities and amenities that will support good health. Yoga and pilates classes are popular in many active adult communities, as well as water aerobics, biking groups, and running clubs.

Additional Resources:

- 55+ Communities Near the Best Hospitals in Florida for Seniors

- The Best Places to Retire for Health Care

- How Do 55+ Communities Handle Health Care and Emergency Services?

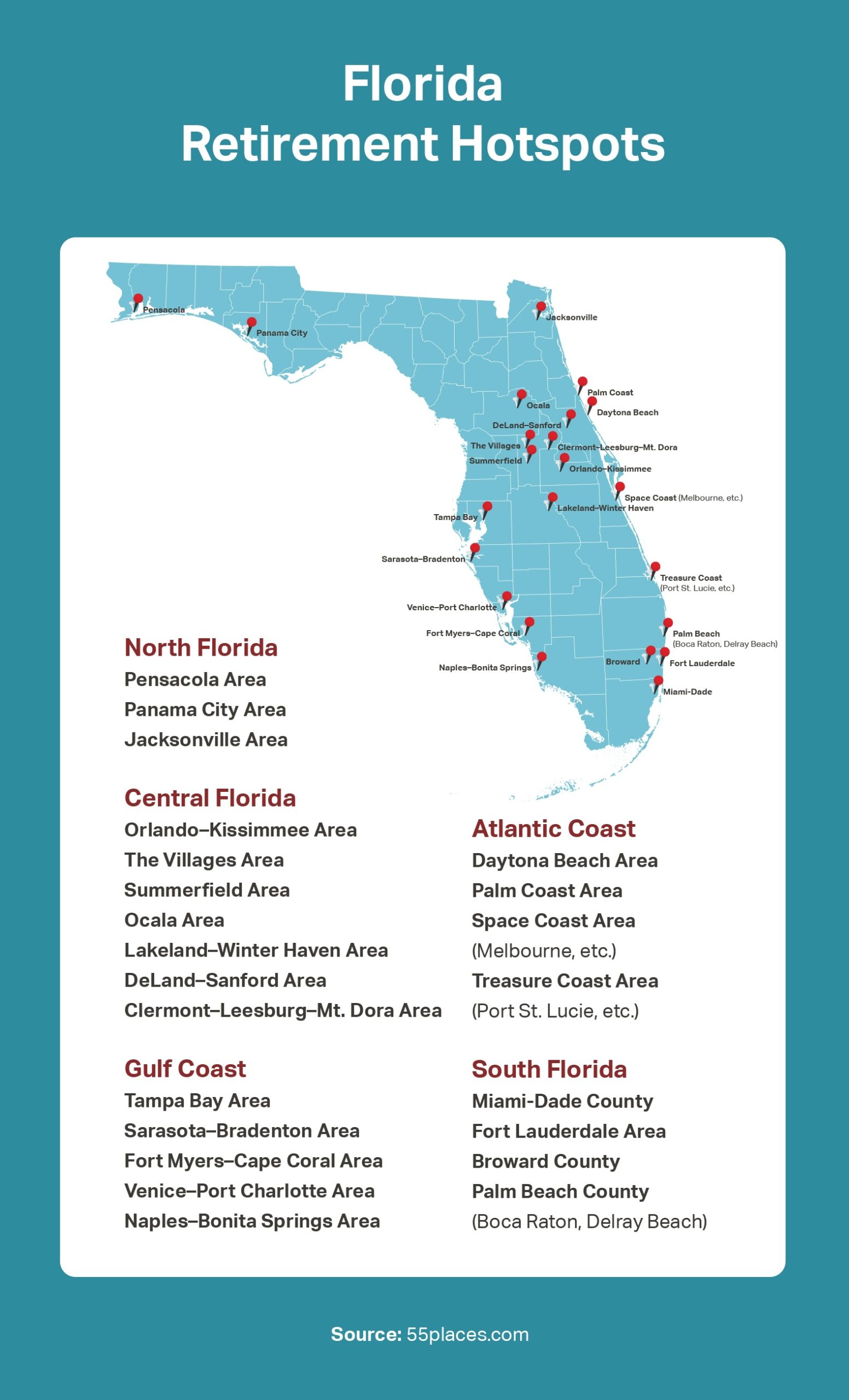

Where to Live When Planning a Retirement in Florida

With over 65,000 square miles of sunshine, shoreline, and scenery, Florida offers endless possibilities—but that can make choosing where to retire feel overwhelming. Do you picture yourself on the breezy Atlantic coast or the laid-back Gulf side? Would you rather be near Orlando to entertain visiting grandkids, or tucked away in a quiet town with a golf course in your backyard? Whether you’re dreaming of waterfront views, walkable neighborhoods, or vibrant city energy, it’s time to start narrowing down what part of Florida feels like home.

Let’s take a look at the most popular regions and the top cities that attract retirees like you.

Additional Resources:

- Is It Better to Retire on the East or West Coast of Florida?

- Arizona vs. Florida: Which Retirement Destination Is Right for You?

- South Carolina vs Florida: Which Is Better for Retirement?

- Georgia vs Florida: Which Is Better for Retirement?

North Florida

Pensacola

Pensacola is tucked into the northern curve of Florida’s northern Gulf coast. This area has a lower cost of living than the southern cities, and it’s also less tourist-filled. Imagine white sand beaches, lots of nature and wildlife, and a military-friendly community that’s built around the Naval Air Station Pensacola.

Residents enjoy the coastal small-town charm of this city as well as its historic downtown area and thriving arts scene. It’s just 13 miles from the Alabama border. The housing market is a diverse mix of affordable single-family homes and waterfront properties. Also, there has been recent growth in suburban developments, including 55+ communities.

Panama City

Panama City is in the Panhandle, on Florida’s Emerald Coast. Housing costs are lower here than they are in larger Florida cities, and there’s a military presence here, thanks to Tyndall Air Force Base. There are some beautiful beaches nearby, leading to a laidback coastal lifestyle. People here love to fish, boat, and hike through some of the local parks like St. Andrews State Park. The housing market is competitive, with affordably priced condos being the most popular type of home.

Jacksonville

Jacksonville is on the northern Atlantic coast of Florida, and it’s one of the fastest-growing cities in the U.S. Atlantic beaches offer big waves, great fishing, and a lot of peaceful solitude, especially in places like Little Talbot Island State Park.

Neighborhoods in this area are growing, and there’s plenty of art, culture, music, dining, and shopping that residents expect from a large city. There are dozens of historic neighborhoods and new construction condos along the St. Johns River. Coastal communities such as Atlantic Beach are also popular. For active adult homebuyers, the housing market offers golf course communities, new construction developments, and mixed-use and master-planned communities.

Additional North Florida Resources:

- The Best Retirement Communities in the Florida Panhandle

- Where to Retire on Florida’s Gulf Coast: Southwest vs. Northwest Florida

- Why You Should Retire in Jacksonville, Florida

Central Florida

Orlando-Kissimmee

Orlando-Kissimmee is in the heart of Central Florida, and a hotspot for family vacations and theme park daytrippers. Residents love the ease of Orlando International Airport, and there’s a ton of shopping, dining, and entertainment to enjoy.

Orlando has grown tremendously over the last decade, pushing many neighborhoods and 55+ communities out into suburbs like Lake Nona and Winter Park. New construction communities are amenity-rich, and there has been an increase in luxury rentals for both permanent residents and short-term visitors. Active adults looking for new construction or recently upgraded resale properties will find something to their liking. Prices have been rising, so review your budget before the house hunting begins.

The Villages

The Villages is one of the nation’s largest 55+ communities, spanning over 30,000 acres across three counties. Home to an estimated 70,000 households, it offers a fully self-contained lifestyle with shopping, dining, health care, and 100+ miles of golf cart–friendly roads connecting its neighborhoods and amenities.

This is an iconic 55+ community with national name recognition. Every amenity imaginable is available throughout the communities in The Villages, from pickleball to swimming pools to woodworking studios to wine cellars. Also, there’s an endless social calendar of club activities, social events, classes, and parties. Demand has remained high for the single-family homes, attached villas, and resale condos throughout The Villages.

Summerfield

Summerfield is just outside of Ocala, off Interstate 75, and offers a more affordable and less crowded alternative to The Villages. Communities are a bit smaller, the pace of life is a bit slower, and residents enjoy taking the time to admire grazing horses behind white picket fences and rolling hillsides. There are lakes, nature trails, and good golfing to enjoy in the area, and retirees will find affordable housing options with single-family homes on large lots and condos in new construction neighborhoods.

Ocala

Ocala is the heart of horse country. There are numerous equestrian facilities in the area, including the impressive World Equestrian Center. Housing is more affordable here, and there are dozens of 55+ communities offering single-family homes and low-maintenance condos. There’s an expanding inventory of new construction homes, and this area is close to Gainesville, Orlando, and Tampa.

Lakeland-Winter Haven

Lakeland-Winter Haven is perfect for retirees who want to be somewhere between Orlando and Tampa, but not right in the city. It’s affordable and quiet, but less than an hour to either metropolitan area. Lovely lakes, flights of swans, historic downtown buildings, and expansive hiking trails can be found in this area. Housing is affordable, and it takes no time at all to get to the Orlando airport or the Gulf beaches.

Deland-Sanford

Deland-Sanford is a quaint area full of antique shops, local restaurants, historic buildings, and little libraries. Nature abounds, with freshwater springs and local rivers inviting residents to kayak, canoe, fish, and camp. Older homes in established neighborhoods can be purchased for a steal, and some new 55+ communities are popping up for retirees who want modern amenities and open floor plans. These neighborhoods are close to Orlando, but there’s less traffic, fewer tourists, and a more serene way of life.

Clermont-Leesburg-Mt. Dora

Large lakes, pretty trees, and rolling hills are the vibe in this part of Central Florida, where there’s growing interest from retirees. Weekends are full of farmers markets, art festivals, antiques, and the occasional motorcycle rally. There’s a growing presence of 55+ communities, and most of them offer new construction homes. This is an affordable area for active adults who are looking for a more rural environment surrounded by water but not at the beach.

Additional Central Florida Resources:

- 7 Popular Gated Communities in Florida’s Clermont-Leesburg Area

- Discover Why Sanford, Florida Is Among the Best Active Adult Retirement Destinations

- Central Florida Communities With No Age Restrictions

Gulf Coast

Tampa

Tampa and the surrounding Bay area offer a lot of city amenities, including theaters, museums, and professional sports. There’s also a lot of water, from Tampa Bay to the Hillsborough River to the Gulf.

Diverse neighborhoods are found throughout the area, and the suburbs have grown into what was once farmland. The Tampa Riverwalk has been recently updated, and neighborhoods like Ybor and Hyde Park bring culture and history as well as delicious food and local shops. The housing market is large and offers many 55+ communities with golf courses, city views, water views, and proximity to preserves and parks. There’s a large range of prices, depending on whether buyers want an economical condo or a luxury single-family home near the water.

Sarasota-Bradenton

Sarasota-Bradenton is just south of Tampa and also along the Gulf coast, providing access to beautiful beaches. Lots of culture can be found in Sarasota’s arts district and museum scene, anchored by the impressive Ringling Museum. When it comes to finding a Florida retirement home, many new construction and upscale condos are available in 55+ communities—many of them near the water. Luxury communities are also popping up, driving up prices and property values.

Fort Myers-Cape Coral

Fort Myers-Cape Coral is great for boating and fishing, and a popular spot for snowbirds to settle for at least part of the year. Master-planned communities with long lists of amenities can be found throughout the area and close to the Caloosahatchee River. Plenty of affordable housing can be found, especially for active adults willing to live a bit further from the water.

Venice-Port Charlotte

Venice-Port Charlotte is great for beachcombers looking for treasures because Venice is the “Shark Tooth Capital of the World.” Also, peaceful, walkable downtown areas can be found in local communities. Housing is more affordable than in other Gulf cities, and there are beautiful canals and parks to enjoy. Look for affordable resale homes and new construction 55+ developments.

Naples-Bonita Springs

Naples-Bonita Springs offers luxury living for retirees, and there are lots of high-end shops and upscale restaurants. Art, golf, and beaches are a way of life here, and the 55+ communities have been designed with these things in mind. There’s a steady demand for housing in this area, even with prices trending much higher than in other areas.

Additional Gulf Coast Resources:

- Where to Retire on Florida’s Gulf Coast

- 7 Popular Gated Communities in Fort Myers

- The Most Affordable Retirement Communities in Tampa, FL

- Luxury 55+ Communities in Naples, Florida

Atlantic Coast

Daytona Beach

Daytona Beach lives up to its reputation for fun in the sun. The beaches are iconic, and cars are welcome on some of them. The area is known for its festivals and annual events, such as the Daytona 500 and Daytona Bike Week. For being a beach town, it’s relatively affordable, and there’s a mix of condos and single-family homes in 55+ communities near the beach and further inland.

Daytona Beach is also home to Latitude Margaritaville. This iconic 55+ community offers resale homes, vibrant amenities, and a laid-back lifestyle inspired by Jimmy Buffett. It combines tropical vibes with resort-style living, including dining, entertainment, and recreation—all just minutes from the beach.

Palm Coast

The Palm Coast area offers a blend of natural beauty, recreation, and affordability. Residents enjoy easy access to top-rated golf courses, scenic beaches, and an abundance of parks and nature preserves. The region is home to both established neighborhoods and newly developed communities, with lower taxes adding to its appeal. Housing options range from budget-friendly condos near the water or on the golf course to more luxurious homes, making it accessible for a variety of lifestyles and budgets.

The Space Coast

The Space Coast has some great cities like Melbourne and Vero Beach to explore. There are beaches and lagoons, and a space shuttle could be launching at any time. A growing tech community has emerged thanks to the aerospace interests, and home prices remain comparatively affordable. Plenty of established neighborhoods offer older homes, and new construction communities are also showing up.

Treasure Coast

Places like Port St. Lucie and Stuart offer many 55+ and master-planned communities with numerous amenities and a wide range of floor plans and home types. People love golfing, watching spring training baseball, and relaxing at the beach. There’s also a growing retiree population in this area, and new construction 55+ communities are quickly meeting the demand.

Additional Atlantic Coast Resources:

South Florida

Miami-Dade County

Miami-Dade County is hard to beat when it comes to city amenities, nightlife, entertainment, culture, and diversity. Beaches, global cuisine, and high-rise condo living with fantastic views are all available for a retirement in Miami. Expect a competitive and pricey housing market, especially if a luxury condo is what you’re after. Single-family homes and attached villas can also be found, and those high prices are because everyone wants to live in Miami.

Fort Lauderdale

Fort Lauderdale offers sophistication and city vibes, but at a more affordable price point. Beautiful beaches and lots of boating can be found on the shores of this city, and residents love cruising through the canals, enjoying art walks, and sampling food from the growing culinary scene. It’s more affordable than Miami, but prices are still high, especially for waterfront condos and spacious single-family homes in planned communities.

Broward County

Close to Miami and Fort Lauderdale but a bit outside of the city limits is Broward County, which offers beaches and a more suburban lifestyle. Cities like Pembroke Pines, Coral Springs, and Plantation offer more affordable housing, and there’s also a selection of upscale condos and homes. Retirees will find a large number of 55+ communities to choose from.

Palm Beach County

Palm Beach County has a lot of art and culture as well as beautiful beaches. Cities like Boca Raton and Delray Beach offer trendy and walkable downtown areas full of shops and restaurants. Housing prices are high, and so are property taxes, but the rewards are well-landscaped gated communities, many with golf courses.

Additional South Florida Resources:

Housing Options for Retirement in Florida

With its size and diversity, Florida offers retirees a wide range of housing choices to fit every lifestyle and budget. From affordable condos and low-maintenance townhomes to spacious single-family homes and luxurious waterfront villas, there’s no shortage of options. Each property type comes with its own set of advantages and potential trade-offs, so it’s important to think beyond just square footage.

Before choosing your next home, consider the following factors:

- Budget: Factor in more than just the purchase price. Property taxes, HOA fees, insurance costs, and potential hurricane-related expenses can vary significantly by location and community.

- Lifestyle: Do you want to be steps from the beach, or is a peaceful water view enough? Are you dreaming of a golf course community, or is a maintenance-free home where you don’t have to mow the lawn more your style?

- Health & Mobility Needs: Many retirees prioritize single-level living, wide doorways, or communities with access to health care and wellness amenities.

- Residency Plans: Your needs may differ depending on whether you’re moving to Florida full-time or planning to split your year as a part-time snowbird.

Florida’s housing market offers the flexibility to match your retirement goals, whether you’re looking for easy living, active social scenes, or your own private retreat.

55+ Communities in Florida

Retirees often appreciate the ease of moving into a 55+ community. Common features include gated or secure entries, clubhouses, and pools, and an HOA to handle a lot of the heavy lifting. The age restrictions keep the community a bit quieter and encourage residents to befriend their neighbors.

Florida offers a wide variety of home options for 55+ active adults, catering to different lifestyles, preferences, and budgets. Buyers can choose from low-maintenance condos, attached villas, and single-family homes in both new construction communities and established neighborhoods. Many homes are designed with active adult living in mind, featuring open floor plans, first-floor primary suites, energy-efficient upgrades, and outdoor living spaces. Gated communities often provide lawn care and exterior maintenance, making them ideal for snowbirds or full-time residents seeking a lock-and-leave lifestyle.

Active adults gravitate towards the sense of community, the shared interests, and the busy social calendars that ensure both physical and mental well-being. Some of the areas in Florida with the highest number of 55+ communities per capita include Sarasota, Palm Beach, Port St. Lucie, Ocala, and Melbourne.

Additional Resources:

New Construction or Resale?

For many retirees moving to Florida, the idea of a brand-new home is especially appealing. No previous owners, modern floor plans, and the chance to personalize features like flooring, countertops, and appliances make new construction a popular choice. In Florida, these homes are often built with energy efficiency and smart technology in mind, perfect for comfort and long-term savings. Many builders offer incentives, such as assistance with closing costs or complimentary upgrades. However, new construction homes in Florida often come with a higher price per square foot, and they’re frequently located in newer developments that may be farther from the coast, city centers, or established amenities.

On the other hand, resale homes can offer convenience and value. Many 55+ buyers in Florida prefer resale homes because they’re typically move-in ready, located in more mature neighborhoods, and priced lower than new builds. These communities often feature lush landscaping, mature trees, and a more settled atmosphere. The trade-off? Some of these homes may need cosmetic updates or renovations, and competition can be stiff in popular markets, especially near the beach or in high-demand areas like Sarasota, Naples, or The Villages. Still, for buyers who want a quicker move and a more central location, resale homes remain an attractive and practical choice in Florida’s retirement landscape.

Additional Resource:

Snowbirds Seeking Retirement in Florida

According to Kiplinger, more than one million people spend part of the year living in Florida, making part-time residency a popular way to ease into retirement. For active adults who aren’t ready to commit to a permanent move, spending four to nine months a year in the Sunshine State offers the best of both worlds: warm winters, vibrant communities, and an active lifestyle.

Seasonal rentals are a common choice for snowbirds, with options including condos, apartments, vacation homes, and leased properties in 55+ communities. Most part-time residents arrive between October and April, often signing three- or six-month lease agreements. If you’re considering this lifestyle, keep these two key factors in mind:

- Community Rules & HOA Approval: Not all communities allow seasonal rentals or part-time residency. Many 55+ neighborhoods require HOA approval and may have restrictions on lease terms or minimum residency periods. Be sure to review the community’s bylaws and regulations before signing a lease.

- Furnished vs. Unfurnished: For shorter stays, furnished rentals are preferred and often expected. Most snowbirds aren’t looking to move furniture for a three-month stay. Unfurnished rentals are more typical for long-term or year-round leases.

Rental prices vary by region and proximity to the coast:

- Miami & South Florida: Expect to pay $3,500+ per month, especially for condos near the beach.

- Atlantic Coast: One-bedroom rentals typically start at $2,000/month, with higher prices for beachfront or larger homes.

- Gulf Coast: Prices range from $1,500 to $3,000/month. Popular areas like Naples command higher rents than quieter spots like Wimauma.

- Central Florida: Monthly rents usually fall between $1,800 and $2,500, depending on home size and location.

- Northeast & Northwest Florida: More affordable markets like Jacksonville and Pensacola often offer well-appointed homes for under $2,000/month.

For retirees looking to test the Florida lifestyle or split their time between states, snowbird living provides flexibility, comfort, and a warm escape from winter.

Additional Resources:

Average Florida Home Prices in 55+ Communities

Home prices in Florida vary widely. When it comes time to buy, the value of a property depends on a range of factors that can significantly impact the price point. Some of the biggest influences include:

- Proximity to water – Homes on the waterfront or even just near the coast typically command higher prices.

- Golf course or country club access – Properties within these communities often come with premium price tags due to the lifestyle and prestige.

- Community amenities – Pools, fitness centers, clubhouses, and social programming can add value.

- Age of the home and community – Newer construction tends to be more expensive, while older homes may require updates but offer better value.

- 55+ vs. all-ages communities – Age-restricted communities can offer more predictable pricing and amenities tailored to retirees, but prices still vary by location and features.

Don’t forget the role of local market conditions. Demand in Florida’s most popular retirement areas—like Naples, Sarasota, or The Villages—can cause prices to rise quickly. Markets shift, sometimes within weeks, so it’s important to stay informed and work with a local expert who understands pricing trends in the specific region you’re considering.

Additional Fees for Florida Retirement Homes

There’s the purchase price, and then there’s everything else.

HOA fees should be expected, and they can range from $100 to $1,000, depending on what’s included. While the fee can seem annoying, there are actually many benefits to buying in an HOA community. These associations typically cover lawn care and landscaping, security throughout the community, exterior maintenance, road and sidewalk conditions, and access to clubhouses and amenities. In some communities, the HOA fee includes cable, water, and internet.

Always ask about the HOA before buying a home in a 55+ community. You want to understand the rules and the requirements, but you also want to know how active the association is when it comes to enforcement, events, and communication. Check out the reserves so you know it’s a financially sound association. Get to know who is managing the community.

Additional Resources:

- Benefits of an HOA: Why 55+ Homebuyers Want a Homeowners’ Association

- Buying a Home With or Without an HOA

- Everything You Need to Know About a 55+ Community HOA

Lifestyle & Recreation

According to the American Psychological Association, spending time in nature is good for mental health and also likely to improve cognitive function. There are benefits to getting outside in the fresh air, and a retirement in Florida makes it easy to spend more time outside.

There’s plenty to do for outdoor enthusiasts, patrons of the arts, sports-minded adventure seekers, and those who are satisfied to sit at the beach with a book. Let’s take a look at some of the iconic recreation Florida has to offer:

Outdoor Activities

Golf

According to the National Golf Foundation, Florida is a golfer’s paradise, boasting more golf courses than any other state. With over 1,400 public courses available, players of all skill levels can enjoy everything from scenic executive courses to challenging championship layouts.

In addition to more than 1,400 public golf courses, many private clubs offer exclusive experiences through memberships, often with resort-style amenities. Golf is a major draw in 55+ communities across the state, and many feature onsite courses designed to attract active adults who want to play regularly. Top golf-friendly destinations in Florida include Naples, The Villages, Palm Coast, and Sarasota—each known for its vibrant golf scene and year-round playing conditions.

Additional Resources:

- The Best Golf Communities in Florida

- The Best Golf Communities in Naples, Florida

- Florida Golf Communities With Homes for $400k

Boating

A treasured retirement hobby, boating in Florida can mean taking to the open sea or floating around a lake or river. This is a lifestyle choice in communities along the Gulf Coast, and some 55+ communities in Naples, Cape Coral, and Venice have their own marinas and docks. These are popular regions for canal homes and boating clubs. On the Atlantic side, look for exceptional boating opportunities in Vero Beach and Palm Beach. Bring your own boat or rent one at one of the many marinas.

Additional Resources:

Fishing

Deep-sea fishing means setting out from Tampa, Miami, or even the Keys. Freshwater fishing is also popular in places like Lake Okeechobee, Mount Dora, and the St. Johns River. Charter companies are found up and down the Florida coasts, and airboat rides are popular in Central Florida, particularly Ocala and Leesburg. Anglers will want to explore South Florida for grouper and snapper, but don’t forget North Florida. Destin is considered The World’s Luckiest Fishing Village thanks to the depth of its waters and the diversity of its fish.

Additional Resources:

Tennis and Pickleball

Tennis has always been a great way for retirees to stay active and healthy, and the pickleball trend has seriously taken over across the state. You’ll find courts for both tennis and pickleball in a majority of 55+ communities. There are leagues, clubs, and lessons available. The Villages hosts a Pickleball Open, and The U.S. Open Pickleball Championships are held in Naples every year. Tennis clubs in communities around Boca Raton and Sarasota offer an opportunity for social interaction as well as improved backhands.

Additional Resources:

Arts and Culture

Museums, theaters, and festivals—a lot is happening in the Florida art scene. Expect outdoor art walks in cities like Sarasota, Jacksonville, and Palm Beach. Museums and galleries are numerous, and sometimes, visitors can even watch an artist working in their studio. The Wynwood Arts District in Miami is known for this.

Retirees can benefit from memberships and subscriptions, many of which are offered at a discount for residents and seniors. Also, many 55+ communities organize outings to museums, seafood festivals, and jazz concerts. Check out the events calendars at these communities; tickets are often needed in advance, and they sell out quickly.

Artistic Hotspots for Active Adults in Florida

Retirees enjoy year-round live music at major venues such as Hard Rock Live in Hollywood, The Social in Orlando, and Amalie Arena in Tampa. Festivals include the Food and Wine Festival at Epcot Center, Gasparilla Pirate Fest in Tampa, and the Miami Book Fair.

Some cities are especially gifted at providing a strong arts scene. Sarasota, for example, has the dramatic Ringling Museum, the celebrated Sarasota Opera House, and the Florida Studio Theatre, with an impressive list of live performances. In Naples, there’s Artis-Naples, which includes The Baker Museum and the Naples Philharmonic.

In St. Petersburg, there’s the Dali Museum, with a rotating series of exhibits and permanent collections from Salvador Dali. The Museum of Fine Arts has a diverse collection, and the entire Tampa Bay area enjoys the SHINE Mural Festival every year.

Miami and Fort Lauderdale offer diverse, avant-garde art and a lot of culture. The Miami Design District is a creative neighborhood with street art, galleries, and shops. The original street art museum is found at Wynwood Walls in Miami, and NSU Art Museum in Fort Lauderdale offers memberships and free admission on the first Thursday of every month. Also, the Broward Center for the Performing Arts is especially well-known for its annual performance of The Nutcracker.

Shopping and Dining

The combination of cultures in Florida means there’s great food coming from all parts of the globe. The choices are almost overwhelming: Cuban food, Haitian food, cuisine from South America, Southern comfort food, and local specialties like scallops, mussels, clams, and oysters served in dozens of different ways.

Some of the most notable food cities known for their celebrity chefs, well-rated restaurants, and availability of fresh, delicious foods include Tampa and its Ybor neighborhood full of Cuban and Italian gems, Miami and its island cuisine and Latin influences, and Naples, where it’s not unusual to pay hundreds of dollars for the best cut of steak. Emerging culinary hotspots are Winter Park, where Turkish restaurants and Mediterranean eateries are all the rage, and Delray Beach, where fresh, local seafood is a specialty.

When it comes to shopping, retirees in Florida gravitate towards upscale shopping experiences found at Worth Avenue in Palm Beach, Waterside Shops in Naples, and The Shops at Wiregrass just outside of Tampa. However, for those who love a bargain, outlet shopping thrives in Florida. Orlando International Premium Outlets is famous for its brand name deals, Premium Outlets in Ellenton is just a short drive from Sarasota, and in South Florida, the Vero Beach Outlets is the place to save money and find discounts.

Nature Parks and Trails

Alligators, manatees, exotic birds, foxes, black bears, deer, wild horses, and even bison roam the landscape in Florida. Parks, preserves, and nature trails are some of the best ways to spot them. Florida has over 170 state parks, dozens of greenways, and national preserves where people can hike, birdwatch, camp, bike, paddle, kayak, canoe, and sometimes hunt and fish.

Here are some of the most popular and well-preserved wild spaces in Florida:

- Everglades National Park has forests, prairies, wetlands, and swamps. The park has over 1.5 million acres of diverse habitat and sensitive ecosystems. It’s most easily accessed from Homestead near Miami.

- Myakka River State Park is about half an hour from Sarasota and rich in wildlife and plant life. It’s one of the oldest and largest parks in the state, and it’s impossible not to see an alligator or two.

- Blue River State Park in Volusia County is especially well-known for the manatees that swim through the area in the winter, seeking warmer waters. Outside of manatee season, this is a popular place for tubing and paddling.

- Ocala National Forest is the oldest national forest east of the Mississippi River. Hike through the scrub, swim in a lake, or paddle down a river. There are fresh springs, mountain biking trails, and the best chance to spot a bear or a bobcat.

- The Legacy Trail connects Sarasota to Venice. It’s 18.5 miles, paved, and a great place for running, biking, and strolling.

An appreciation for greenspace and the desire for daily walks has led to many 55+ communities offering trails, parks, and protected waterfront property within their neighborhoods. Some community walking paths even lead to larger public trails and greenways.

Additional Resources:

Senior Education and Lifelong Learning in Retirement

Many retirees seek ways to learn new things and stay sharp on the topics they already love. The Osher Lifelong Learning Institute (OLLI) recognized this desire and provides non-credit classes in subject areas such as literature, politics, art, health, history, and more. Courses are designed for retirement-aged learners 50+, and class schedules are flexible. These courses can be accessed through participating universities in Florida, such as the University of South Florida, Florida Atlantic University, and the University of Miami.

There are also community colleges and adult education centers in nearly every major Florida city. Retirees can join language classes, take financial planning workshops, and join personal finance classes. There are writing classes, tech classes, and lessons to be learned for everything from first aid to cooking and painting. Broward College has a continuing education department that supports enrichment classes. Palm Beach State College has accessible classes on computer programming, finance, technology, and food.

Libraries can also be a great resource for classes, events, workshops, and lecture series. Retirees can join a book club, learn how to garden, or explore regional history through offerings and events at local libraries and historical societies.

Pros and Cons of Retiring in Florida

Pros of Retirement in Florida

- No State Income Tax – Florida is one of only nine states with no state income tax, so retirees keep more of their Social Security benefits, pensions, IRAs, and 401(k) withdrawals. Federal income taxes will still apply.

- Warm, Sunny Weather – Sunny days are the norm, with Florida averaging more than 230 sunny days per year, depending on the region. This makes it easier for retirees to enjoy outdoor living and activities such as golf, fishing, swimming, hiking, and community events like farmers markets and open-air concerts.

- Active Outdoor & Social Lifestyle – How else can we say it…Florida is fun! There are more golf courses than you can play, pickleball is both recreational and competitive, and the beaches are always busy with sunbathers, swimmers, paddleboarders, and surfers. The 55+ communities in every part of the state are centered around a healthy and social lifestyle. There are clubs, activities, fitness centers, and invitations to participate in classes and events. There’s a wide range of activities available to residents, from boating and dance classes to yoga and book clubs.

- Strong Health Care Infrastructure – Preventative care and wellness are the way to go in retirement, and there’s a strong health care system for retirees in Florida. Nationally ranked hospitals like Jacksonville’s Mayo Clinic and the Cleveland Clinic in Weston make it easy for residents to stay healthy and manage chronic conditions. Coverage is easy to obtain too, thanks to Florida’s active enrollment in Medicare Advantage plans.

- Cultural Diversity and Accessibility – Florida’s diversity is one of its strengths, and there’s an especially large hub of multicultural communities and neighborhoods in South Florida, where international music, cuisine, and culture can be found in 55+ communities and local hotspots. Airports in Miami, Tampa, and Orlando make global travel easy, and highways like Interstate 4, Interstate 95, and the Florida Turnpike make intrastate travel easy. Cruise ships roll into Miami, Fort Lauderdale, Tampa, and Jacksonville.

Additional Resources:

- The 6 Sunniest Places to Retire in the U.S.

- Outdoor Activities To Love Near 55+ Communities

- Experience the Great Outdoors: Discover Nature-Friendly Active Adult Communities

- Cruises in Florida: Where to Live for Easy Sailing

Cons of a Florida Retirement

- Summers – The weather is a major plus in Florida, but that might be hard to remember in August, when it’s humid, hot, and sticky. Residents come to appreciate air conditioning from June to September, and some full-time residents who have lived here long enough find themselves seeking out cooler climates when the summer season rolls around. We call them reverse-snowbirds.

- Hurricane Season and the Risk of Storms – Hurricanes are a real threat, even in Central Florida, where there’s zero chance of a direct hit. Flooding and high winds are still possible. The hurricane season runs from June 1 to November 30, and while the entire state needs to prepare for tropical weather, coastal areas like the Gulf and South Florida need to be especially vigilant. Bad hurricanes have also recently hit the Panhandle and done some damage to the mid-Atlantic coast.

- Rising Homeowners Insurance Costs – Insuring a property has become more expensive in Florida, and that’s due to the risk of storms and a lot of litigation issues that insurers are still recovering from. Florida homeowners’ insurance policies come with high premiums. This can be a deciding factor when retirees choose where to live and whether they should rent or buy a home.

- Traffic and Tourist Crowds – Florida is a great place to live, but it’s also a great place to visit, and that makes full-time residents fussy from time to time, especially during peak seasons like spring break. Also, seasonal populations jump from November to April, when snowbirds come to town. This means a longer wait at your favorite restaurant and a bit more traffic on the roads. Cities like Naples, Sarasota, and Orlando are especially likely to see congestion during peak months, and this can be frustrating. It also impacts local infrastructure. Some cities are ready for it, but others are not.

Additional Resources:

- Why Warm Climates Are Popular for Retirement

- The Best Places To Retire in Florida Without Hurricanes

- Weathering the Storm: Does an HOA Cover Hurricane Damage?

- Homeowners Insurance for Seniors: A Comprehensive Guide

- Understanding Florida Homeowners Insurance: What to Expect and How to Prepare

Reasons a Retirement in Florida is NOT for You

Florida isn’t for everyone. Visiting the Sunshine State is a lot different from living here. This move is not right for anyone who needs the full four seasons. In Florida, there is summer and there is not-summer. If you have a low tolerance for high temperatures and extra humidity, this is not your place.

If you have storm anxiety or a lot of expensive personal items that you could not imagine losing in a flood or a hurricane, it may be worth rethinking the Florida retirement. The weather here can be disruptive to livelihoods, golf games, and mental health.

A tight budget can also be a problem in Florida. There are expensive insurance premiums, potentially high HOA fees, and prices are only going up. Also, Florida isn’t exactly quiet. This is the right place for many active adults to retire, but for anyone hoping to slow down and live a secluded life, many of Florida’s cities and towns may seem overwhelming and too populated.

And lastly, forget about your mountain hikes. Florida is generally flat. If you need to see peaks in the distance, this is not your place.

Additional Resources:

Moving and Planning Tips

The first step is deciding when to make the move. For seasonal residents, also known as snowbirds, early November is a popular time to head south. Most part-time Floridians arrive in late fall and return north in early spring. Full-time retirees, on the other hand, have more flexibility and can choose a timeline that aligns with their personal needs and lifestyle.

What to Consider Before Leaving

Before packing up for good, take time to assess a few key factors:

- Health Needs: If you’re prone to winter illnesses or managing a chronic condition, time your move to avoid health risks and make sure you’ve scheduled any important appointments or refilled prescriptions.

- Family Responsibilities: Let your loved ones know your plans. If you often care for grandchildren or have other obligations, give them time to adjust to your upcoming absence.

- Financial Timing: If you’re selling a home before buying in Florida, the real estate market and your budget will likely impact your moving schedule.

- Travel Logistics: Long drives, like from upstate New York to Miami, require planning. Account for rest stops, hotel stays, and the comfort of any pets or companions.

Try Before You Buy

If you’re unsure about a permanent move, consider testing the waters:

- Rent First: Many retirees rent for a year before buying to explore different neighborhoods.

- Stay-and-Play Packages: Some active adult communities offer short-term stays so you can experience the lifestyle before committing.

- Set Intentions: Reflect on your personal goals—do you want a packed social calendar, or are you seeking peace and quiet?

Planning a Long-Distance Move

Relocating across state lines takes coordination. These tips can help:

- Hire a Specialist: Look for movers experienced in retirement relocations. The National Association of Senior Move Managers (NASMM) is a great resource for finding certified professionals.

- Book Early: Secure your moving company 6–8 weeks before your move.

- Review the Contract: Understand pricing, delivery timelines, and what’s included.

- Consider Your Vehicle: Decide whether to drive or ship your car—both options have pros and cons depending on your health, time, and budget.

Pack With Florida in Mind

Florida’s climate can affect how you pack:

- Heat-Sensitive Items: Avoid packing candles, electronics, or anything that could melt or warp in the heat, especially in non-climate-controlled trucks.

- Declutter First: Downsizing? Look into services like Caring Transitions and LivNow Relocation to help you sort, donate, or sell items you no longer need.

Prepare Your Paperwork

Each state has its own requirements, so make sure you’re legally ready for your move:

- Driver’s License: You’ll need to get a Florida license after establishing residency.

- Vehicle Registration: Your car must be registered in Florida within 10 days of arrival.

- Tax & Homestead Laws: Get familiar with Florida’s tax benefits and homestead exemptions—local professionals can help explain how they apply to you.

Work With the Right Professionals

Choosing the right team can make your transition smoother:

- Senior Real Estate Specialists (SRES): These agents are trained to work with retirees and understand the emotional and logistical aspects of moving later in life.

- Local Experts: A Florida-based real estate agent can help you navigate homeowners’ associations (HOAs), community fees, local services, and laws.

For additional planning support, the Florida Care Planning Council offers assistance with downsizing, eldercare, and relocation planning.

By thinking through the logistics, getting expert advice, and prioritizing your personal needs, your move to Florida can be a smooth and exciting new chapter.

Additional Resources:

- When Should I Start Planning My Move to a 55+ Community?

- How Long Does It Take To Move to a Different State?

- Planning a Move to a 55+ Community? 9 Moving Tips for Retirees

- Should You Stay In-State or Move Out-of-State When You Retire? 5 Things to Think About

- What Is a Seniors Real Estate Specialist (SRES)? A Complete Guide for Homebuyers and Sellers

- Questions to Ask When Choosing a Real Estate Agent: Working With a 55+ Expert

- Can I Change My Real Estate Agent and How?

- ‘Stay and Play’ Retirement Communities in Florida: Explore the 55+ Lifestyle

- Should You Tour a 55+ Community Before Deciding To Move?

FAQs About Retiring in Florida

Q: Is Social Security taxed in Florida?

A: No, Florida does not tax Social Security income. In fact, Florida has no state income tax at all, which means your retirement income, including pensions, IRAs, and 401(k) withdrawals, is not taxed by the state.

Q: What are the safest areas for seniors?

A: While no area is completely immune to crime, many seniors feel safest in 55+ communities, especially those that are gated or have security features. Popular safe areas for retirees include The Villages, Venice, and Palm Coast—all known for their strong community engagement, low violent crime rates, and senior-friendly amenities.

Q: Is Florida affordable on a fixed income?

A: It depends on the location. Coastal cities like Naples and Miami can be pricey, but inland areas like Ocala, Leesburg, and Sebring tend to have lower home prices and cost of living, making them more suitable for retirees on fixed incomes.

Q: Are there retirement communities near the beach?

A: Absolutely. 55+ communities can be found in coastal towns like Clearwater, Fort Myers, Sarasota, and Daytona Beach. Some offer direct beach access, while others are just minutes from the water.

Q: Do I need hurricane insurance?

A: Most homeowners in Florida will need windstorm coverage, especially in coastal or high-risk areas. Flood insurance is often a separate policy and is strongly recommended if you live in a flood-prone zone. Be sure to check if your mortgage lender requires it.

Q: What’s the best time of the year to move to Florida?

A: For part-time residents, late October to early November is ideal to settle in before peak snowbird season. Full-time movers might prefer spring or fall to avoid the summer heat and hurricane season, which typically runs from June to November.

Q: How do locals deal with mosquitoes and other insects?

A: Floridians use a combination of strategies: regular pest control treatments, citronella candles, screened lanais, and bug spray when outdoors. Many communities also fog for mosquitoes regularly.

Q: How do locals handle the heat and humidity in summer?

A: They plan outdoor activities for early mornings or evenings, use air conditioning indoors, and wear light, breathable clothing. Staying hydrated and seeking shade are essential.

Q: What are the most pet-friendly cities in Florida?

A: According to BringFido, Orlando, St. Augustine, Tampa, Naples, and Jacksonville are consistently rated pet-friendly, with dog parks and pet-friendly beaches.

Q: What is the process for buying a home in Florida as an out-of-state buyer?

A: Start by choosing a region and community that fits your lifestyle. Then, connect with a real estate agent licensed in Florida who can assist with virtual tours, offers, inspections, and closing. Remote closings are common, and out-of-state financing is accepted.

Q: What types of natural wildlife might I encounter?

A: Florida is known for alligators, white-tailed deer, black bears, rattlesnakes, otters, seabirds, songbirds, foxes, and the occasional bobcat. The Florida panther is rare and endangered.

Q: How competitive is the Florida real estate market?

A: The market varies widely. Hotspots like Miami, Tampa, and Orlando are very competitive with quick sales and bidding wars. More rural or inland communities tend to have slower-moving markets and better opportunities for negotiation.

Q: Are there restrictions on water usage or lawn irrigation?

A: None statewide. Water restrictions are set locally, often by city or county governments. Many HOAs enforce their own schedules for irrigation. Check with your local utility or HOA for details.

Q: Can I have solar panels on my home in Florida?

A: Yes. Thanks to the Florida Solar Rights Act, HOAs cannot prohibit solar panel installation. However, they may regulate placement for aesthetic reasons, such as not installing panels on street-facing roofs.

Q: What are the most common mistakes people make when moving to Florida?

A: Common pitfalls include underestimating hurricane prep, overlooking insurance costs, failing to update vehicle registration and driver’s license within 30 days, and not researching property tax and HOA fees ahead of time.

Q: How do I establish residency in Florida?

A: To become a resident of Florida, retirees must live in the state for at least half a year. Apply for a state ID or a driver’s license at the local Department of Motor Vehicles with a copy of your lease or mortgage as well as picture identification.

Q: Is Florida a good state for environmentally conscious living?

A: Yes, especially if you choose energy-efficient communities or LEED-certified homes. Florida also supports recycling programs, wildlife conservation, and renewable energy initiatives. Many retirees enjoy preserving natural lands and volunteering with environmental groups.

Q: How accessible is Florida for people with disabilities?

A: Florida adheres to ADA standards and offers many accessible public spaces, especially in newer communities. The Florida State Parks system is known for offering beach wheelchairs, accessible trails, and adaptive equipment.

Q: Are there tax incentives for relocating to Florida?

A: You won’t get a tax break just for moving here, but most new residents are pleased to avoid state income taxes. There’s also a Homestead Exemption to help full-time residents save on property taxes.

Find Your Perfect Florida 55+ Community Today!

With year-round sunshine, endless recreation, vibrant entertainment, world-class cuisine, and exceptional health care, Florida offers a high quality of life that’s hard to beat. From peaceful beach towns to bustling cultural hubs, the state’s diverse 55+ communities offer something for every lifestyle. Add in the tax benefits and variety of affordable, amenity-rich housing options, and it’s easy to see why so many retirees are making the move.